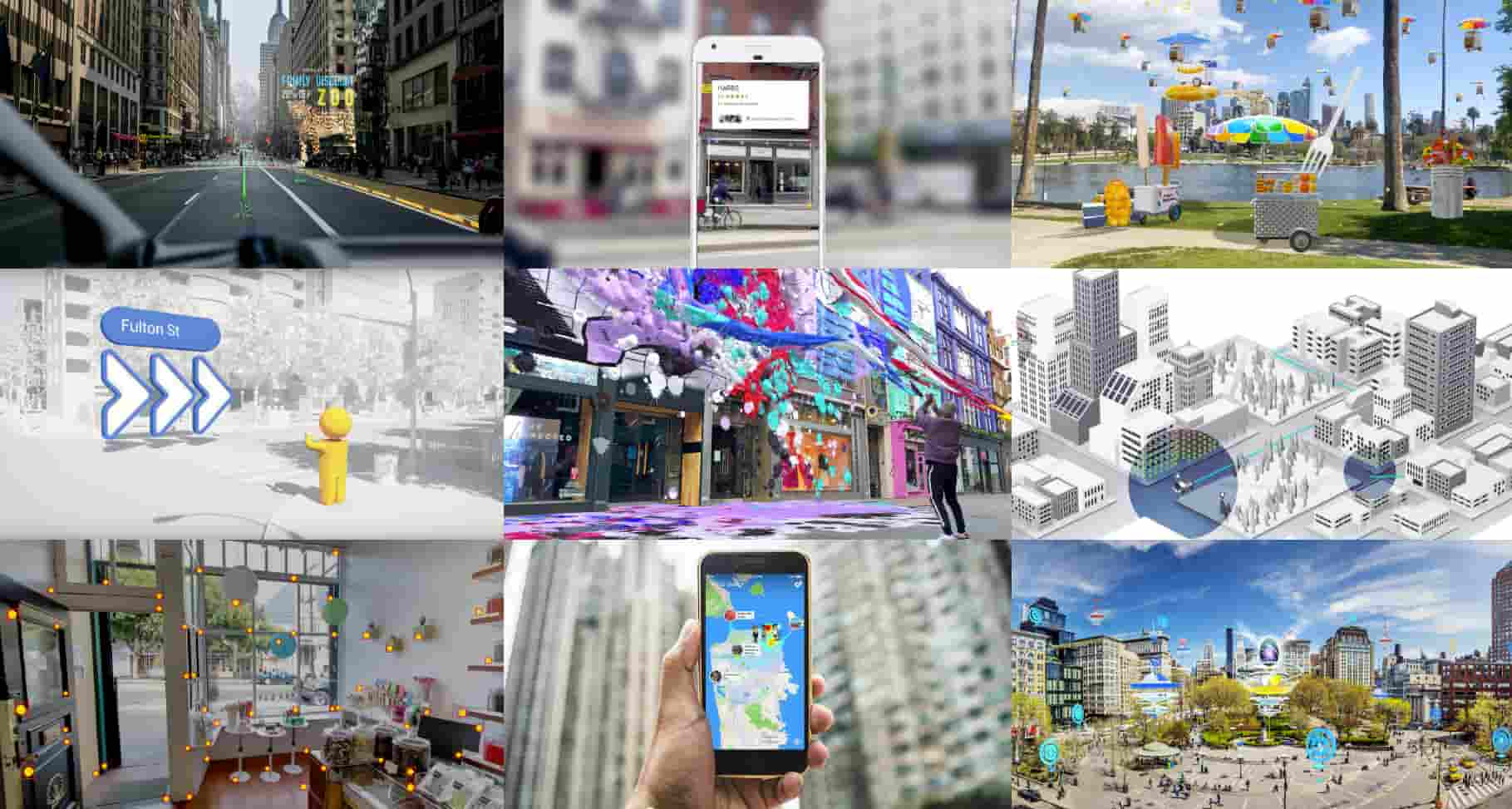

One of AR’s fundamental properties is to fuse the digital and physical. As such, the real world is a key part of that formula… and real-world relevance is often defined by location. As the saying goes for real estate value, it’s all about three factors: location, location, location.

With that backdrop, one of AR’s battlegrounds will be in augmenting the world in location-relevant ways. That could be wayfinding with Google Live View, or visual search with Google Lens. Point your phone (or future glasses) at places and objects to contextualize them.

As these examples suggest, Google has a key stake in this “Internet of Places,” or what we’ve been calling the “metavearth.” It’s driven to future proof its core business, where the camera will be one of many search inputs. And it has valuable geo-local data from products like Maps and Street View to support its efforts.

But Google isn’t alone. Apple signals interest in location-relevant AR through its geo-anchors. These evoke AR’s location-based underpinnings by letting users plant and discover spatially-anchored digital content. Facebook is similarly building “Live Maps” as a component of its multi-sided AR master plan.

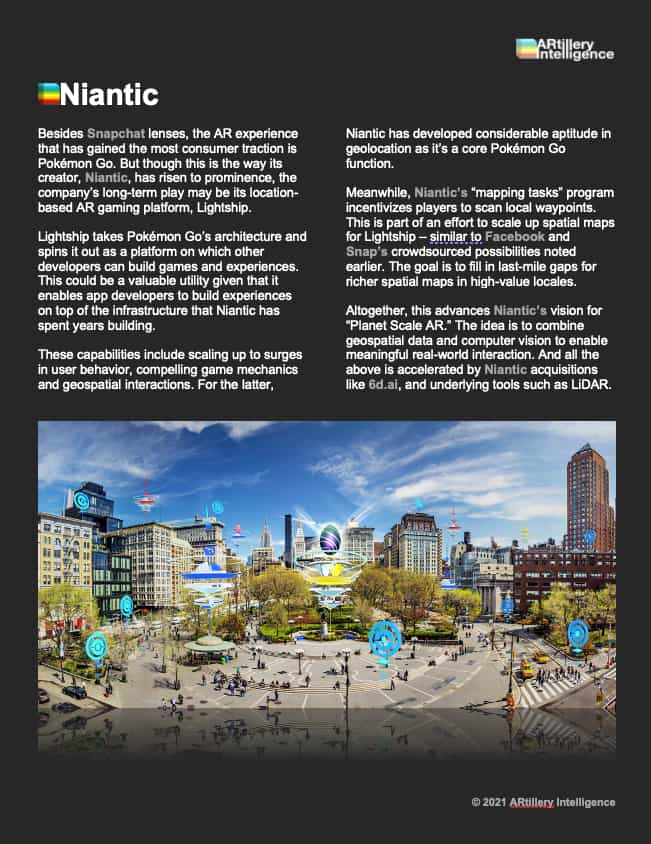

Then there’s Snap, the king of consumer AR. Erstwhile propelled by selfie-lenses, its larger AR ambitions will flip the focus to the rear-facing camera to augment the broader canvas of the physical world. Meanwhile, Niantic continues to rule geo-local AR gaming through Pokémon Go as well as its Lightship platform that will geo-enable third-party AR developers.

Beyond tech giants and other usual suspects, there are compelling startups positioning themselves at the intersection of AR and geolocation. These include Foursquare, Gowalla, ARWay, Resonai, Darabase, YouAR, and a growing list of others.

If any of this sounds familiar, it’s aligned with a guiding principle for AR’s future: The AR cloud. Otherwise known as AR’s metaverse, this is a conceptual framework in which invisible data layers coat the inhabitable earth to enable AR devices to trigger geo-specific experiences.

But true to the many tech-giant efforts just outlined, it won’t just be one cloud or metaverse, as these singular-tense terms suggest. Multiple geo-located AR networks and experiences will compete. Like the web today, the AR cloud will ideally have standards and protocols for interoperability, while allowing for proprietary content and networks to coexist.

But rather than websites, this proprietary content will be in “layers.” The thought is that AR devices can reveal certain layers based on user intent and authentication. You’ll activate the social layer for social-graph activity, and the commerce layer to find products.

There are of course several moving parts. 5G will help achieve millimeter-level precision for geolocated AR. LiDAR will meanwhile unlock advanced optics that can enable the high-scale crowdsourced 3D data needed to spatially map the inhabitable earth. It will be a group effort.

But how will this all come together? What are the missing pieces? And who’s doing what so far? We’ll tackle these questions throughout this report by profiling the biggest players that are planting their flags for the future of geo-local AR. The goal, as always, is to empower you with a knowledge edge.

The fastest and most cost-efficient way to get access to this report is by subscribing to ARtillery PRO. You can also purchase it a la carte.

This report highlights ARtillery Intelligence’s viewpoints, gathered from its daily in-depth coverage of spatial computing. To support the narrative, data are cited throughout the report. These include ARtillery Intelligence’s original data, as well as that of third parties. Data sources are attributed in each case.

For market sizing and forecasting, ARtillery Intelligence follows disciplined best practices, developed and reinforced through its principles’ 15 years in tech sector research and intelligence. This includes the past 4 years covering AR & VR exclusively, as seen in research reports and daily reporting.

Furthermore, devising these figures involves the “bottom-up” market-sizing methodology, which involves granular ad revenue dynamics such as campaign pricing and spending. More about ARtillery Intelligence methodology can be seen here, and market-sizing credentials can be seen here.

Unless specified in its stock ownership disclosures, ARtillery Intelligence has no financial stake in the companies mentioned in its reports. The production of this report likewise wasn’t commissioned. With all market sizing, ARtillery Intelligence remains independent of players and practitioners in the sectors it covers, thus mitigating bias in industry revenue calculations and projections. ARtillery Intelligence’s disclosures, stock ownership and ethics policy can be seen in full here.

Checkout easily and securely.

Ask us anything