Like many research & intelligence firms, one of the things that ARtillery Intelligence does is market sizing. A few times per year, we go into isolation and bury ourselves deep in financial modeling. This takes the insights and observations we accumulate throughout the year and synthesizes them into hard numbers for the current and future spatial computing industry (methodology details here).

In covering spatial computing for eight years, our sector knowledge and perspective continue to expand. That occurs on several levels, including insights and access to insider information, all of which informs our forecast models and inputs. Further reinforcing that knowledge position, the daily rigors of editorial production at our sister publication, AR Insider, embolden our market insights. This also uncovers a steady flow of forecast inputs.

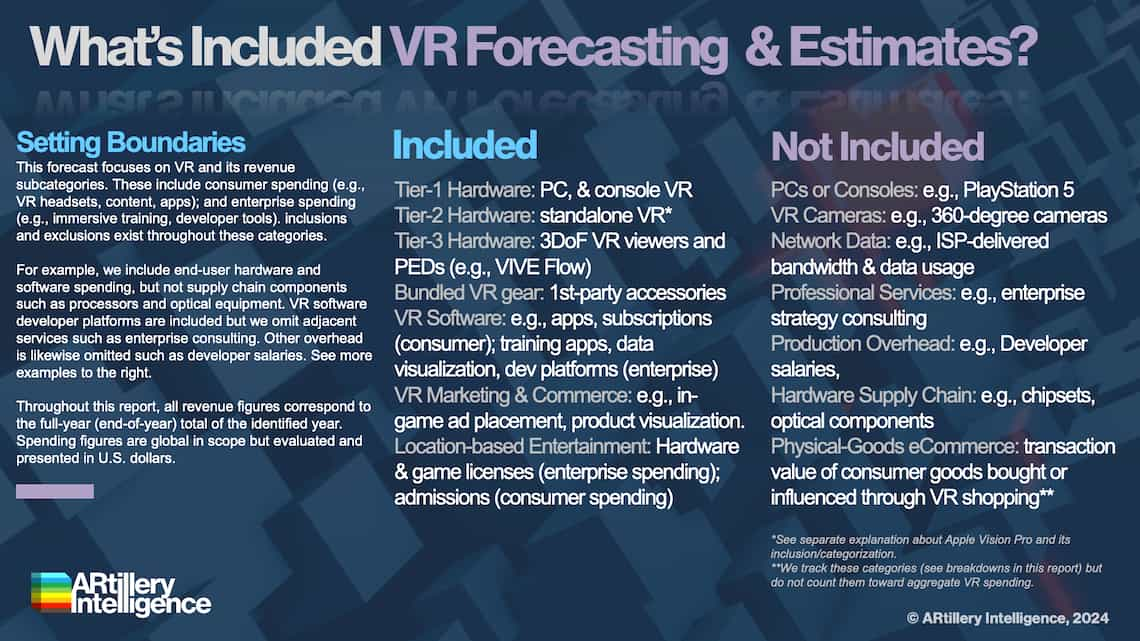

Beyond knowledge position and market-sizing processes, the focus of these forecasts likewise continues to evolve. Our first market forecast six years ago examined AR, VR, and all their revenue subsegments (collectively, XR). More recently, we began to produce separate forecasts for headworn AR, mobile AR, and VR. Though all these areas share technical underpinnings, their nuanced market dynamics deserve deeper and focused treatment.

Accordingly, this report focuses specifically on VR. Specifically, global VR revenue is projected to grow from $11.02 billion in 2023 to $19.75 billion in 2028, a 12.37 percent compound annual growth rate. This leads other XR sectors, such as mobile and headworn AR. Though VR continues to face market challenges and slow-to-moderate growth, it’s the most established of these XR subsegments.

Segmenting the above VR figures, revenue is bisected by consumer and enterprise markets. Though consumer spending is strong – inheriting some demand and market dynamics from the robust gaming industry – enterprise spending has pulled ahead. This is mostly due to VR’s capacity for immersive training, which demonstrates favorable efficacy and efficiency.

Starting with the former, VR’s visceral and experiential qualities elevate muscle memory and informational recall. As for efficiency, VR simulations drive cost reductions versus physical training methodologies, including equipment usage and travel costs to physically interact with training pros and settings. In other words, atoms cost more than bits.

Companies ranging from Coca-Cola to Walmart to Bank of America have realized these advantages and invest heavily in large-scale VR training programs. They’ve validated meaningful savings and greater effectiveness. Consequently, VR training leaders like Strivr and ARuVR monetize the opportunity – which informs the market-sizing throughout this report.

Beyond consumer and enterprise segmentations, VR revenue can be bisected by hardware and software. For several years, hardware had a greater revenue share, as is often the case when new tech sectors emerge. But once a sizable hardware installed base is established, software accelerates and eventually eclipses hardware spend. That happens as software builds on that larger installed base of hardware, and enjoys recurring revenue cycles (think: SaaS), that outpace hardware replacement cycles.

This historical pattern is precisely what we’ve seen in the emerging VR sector. And we are now at the stage when software has eclipsed hardware as a revenue category. In addition to the factors noted above, software spend is lifted by growing areas like game subscriptions (B2C), device management programs (B2B), and LBVR content/game licensing (B2B2C).

Lastly, hanging over all the above is the market acceleration born from Meta’s massive investments. This not only includes tens of billions in R&D but loss-leader pricing in its hardware, such as Quest 3, as it builds towards longer-term goals and a network effect. The result is lower barriers to adoption and benefits to end-users. This is currently VR’s biggest accelerant.

So how do all these principles translate to revenue projections? That’s what we’ll quantify and qualify throughout this report…

The fastest and most cost-efficient way to get access to this report is by subscribing to ARtillery PRO. You can also purchase it a la carte.

ARtillery Intelligence follows disciplined best practices in market sizing and forecasting, developed and reinforced through its principles’ 18 years in research and intelligence in tech sectors. This includes the past 8 years covering AR & VR as a primary focus.

This report focuses on revenue projections in various sub-sectors and product areas. ARtillery Intelligence has built financial models that are customized to the specific dynamics and unit economics of each. These include variables like unit sales, company revenues, pricing trends, market trajectory, and several other micro and macro factors that ARtillery Intelligence tracks.

This approach primarily applies a bottom-up forecasting methodology, which is secondarily vetted against a top-down analysis. Together, confidence is achieved through triangulating revenues and projections in a disciplined way. More about ARtillery Intelligence’s market-sizing methodology can be seen here and more on its credentials can be seen here.

Unless specified in its stock ownership disclosures, ARtillery Intelligence has no financial stake in the companies mentioned in its reports. The production of this report likewise wasn’t commissioned. With all market sizing, ARtillery Intelligence remains independent of players and practitioners in the sectors it covers, thus mitigating bias in industry revenue calculations and projections. ARtillery Intelligence’s disclosures, stock ownership, and ethics policy can be seen in full here.

Checkout easily and securely.

Ask us anything