How do consumers feel about VR? Who’s using it? How often? And what do they want to see next? Equally important, what are non-users’ feelings about the technology? Why aren’t they using it? What would change their minds? And how can VR software and hardware developers optimize products accordingly?

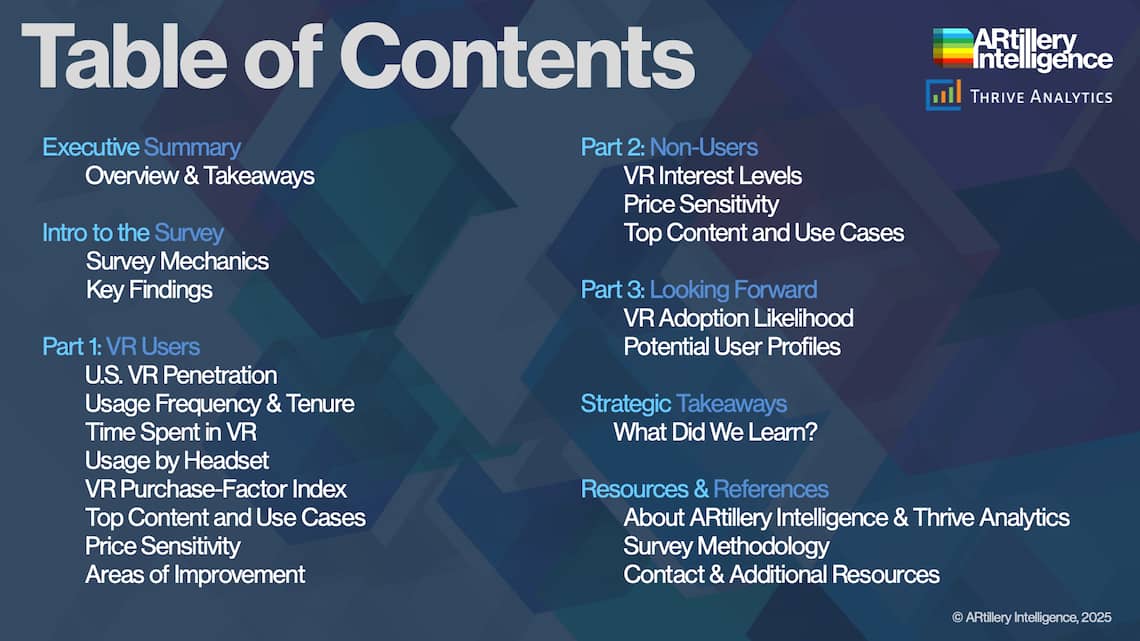

These are burning questions we set out to answer. Working closely with survey research specialist Thrive Analytics, ARtillery Intelligence wrote questions to be fielded to 50,000 U.S. adults through Thrive’s established consumer survey engine. The results are in and we’ve analyzed the takeaways in this report.

This follows similar reports we’ve completed over the past decade, including a corresponding consumer AR survey. Wave 9 of the research now emboldens our perspective and brings new insights and trends to light. All nine waves represent a significant sample of U.S. adults for robust longitudinal analysis. This will continue to expand with each survey wave.

So what did we find out? At a high level, 27 percent of U.S. adults own or have used a VR headset, which is up from 25 percent in Wave 8. Though this is modest growth, the product category is expanding and reaching more meaningful consumer penetration.

This growth is driven by a few factors, including the emergence of mixed reality in VR. As seen in market-defining hardware such as Meta Quest 3 and 3s – as well as high-profile devices like Apple Vision Pro – mixed reality involves HD color passthrough cameras that enable experiences that interact with the real world. In addition to being more capable and immersive, passthrough cameras can engender comfort, orientation, and spatial awareness in VR.

But beyond those positive signals, there continue to be challenges and adoption headwinds. VR hasn’t lived up to its world-changing hopes and promises touted in the industry’s circa-2017 hype cycle… nor its circa-2021 metaverse hype cycle. Since then, VR has been healthy in its own right, but far narrower in consumer adoption than proponents have hoped.

The causes of those adoption challenges are signaled in these survey results. For example, only 20 percent of non-users say that they want to try the technology. Though existing users show strong demand signals and engagement, there’s a clear delineation in overall sentiment between VR users and non-users.

The disparity between current-user engagement and non-user disinterest underscores a key “chicken & egg” dilemma for VR. To reach high satisfaction levels, VR must first be tried. Yet non-users, per the above, have little interest in doing so. Altogether, this presents a sizable marketing challenge for VR players and proponents to convert non-users into users.

But if anything is going to bring that interest to mainstream markets, it’s the aggressive pricing and quality of Meta devices. In an effort to blitz market share, Meta subsidizes its hardware to the point of deflating its own margins. The good news for consumers is that they get access to quality VR hardware that’s more affordable than it should be.

These factors continue to attract users, which then attract developers. As game & app libraries build in this way, a virtuous cycle – or flywheel effect – drives the VR market. This is the path to VR growth. But to be clear, it will continue to be a gradual process as VR ratchets up slowly and steadily in the above ways.

The fastest and most cost-efficient way to get access to this report is by subscribing to ARtillery PRO. You can also purchase it a la carte.

ARtillery Intelligence follows disciplined best practices in market sizing and forecasting, developed and reinforced through its principles’ 20 years in research and intelligence in the tech sector. This includes the past 10 years covering AR & VR as a primary focus.

ARtillery Intelligence has partnered with Thrive Analytics by writing the questions for the Virtual Reality Monitor consumer survey. These questions were fielded to more than 50,000 U.S. Adults. ARtillery Intelligence wrote this report, containing its insights and viewpoints on the survey results.

For market sizing and analysis, ARtillery Intelligence follows disciplined best practices, developed and reinforced through its principles’ 20 years in research and intelligence in the tech sector. This includes the past 10 years covering AR & VR exclusively, as seen in research and daily reporting.

Thrive Analytics likewise follows best practices in consumer research, developed over its long tenure as a consumer research firm. More details about the survey sample can be seen in this report’s introduction, and more on ARtillery Intelligence’s research methodology can be read here.

Unless specified in its stock ownership disclosures, ARtillery Intelligence has no financial stake in the companies mentioned in its reports. The production of this report likewise wasn’t commissioned. With all market sizing, ARtillery Intelligence remains independent of players and practitioners in the sectors it covers, thus mitigating bias in industry revenue calculations and projections. ARtillery Intelligence’s disclosures, stock ownership, and ethics policy can be seen in full here.

Checkout easily and securely.

Ask us anything