Like many research & intelligence firms, one of the things that ARtillery Intelligence does is market sizing. A few times per year, we go into isolation and bury ourselves deep in financial modeling. This takes the insights and observations we accumulate throughout the year and synthesizes them into hard numbers for the current and future spatial computing industry (methodology details here).

In covering spatial computing for eight years, our sector knowledge and perspective continue to expand. That occurs on several levels, including insights and access to insider information, all of which informs our forecast models and inputs. Further reinforcing that knowledge position, the daily rigors of editorial production at our sister publication, AR Insider, embolden our market insights. This also uncovers a steady flow of forecast inputs.

Beyond knowledge position and market-sizing processes, the focus of these forecasts likewise continues to evolve. Our first market forecast seven years ago examined AR, VR, and all their revenue subsegments (collectively, XR). Since then, we’ve evolved towards separate forecasts for headworn AR, mobile AR, and VR. Though all these areas share technical underpinnings, their nuanced market dynamics deserve deeper and focused treatment.

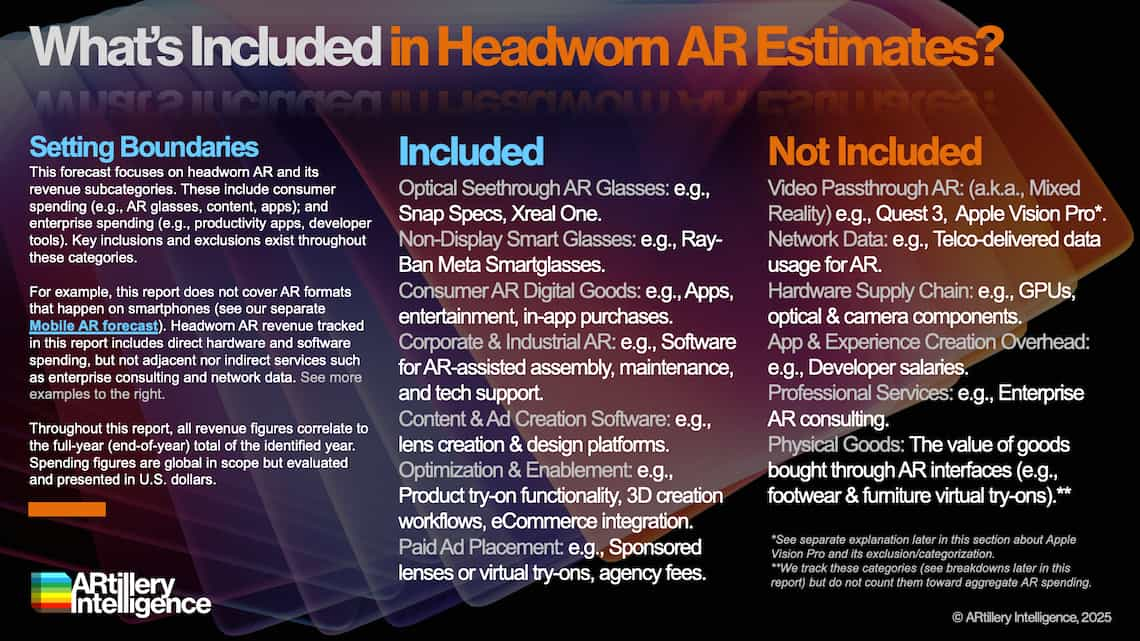

Accordingly, this report focuses on headworn AR. Given its unique dynamics – in both technology and user adoption patterns – it compels its own focused analysis. This allows us to go deeper into key revenue sources like consumer (B2C), enterprise (B2B), and AR-enablement software (B2B2C). We did this last quarter for mobile AR, as we’ll do next quarter for VR, and in Q4 to end the year with the entire XR sector.

So what did we find out? Headworn AR revenue is projected to grow from $2.61 billion in 2024 to $13.05 billion in 2029, a 37.92 percent compound annual growth rate. This trails other XR sectors we track, such as mobile AR and VR, as they’re at more advanced stages. Though headworn formats represent AR’s endgame, they’re at earlier lifecycle stages today, due to highly-advanced underlying tech.

All the above has inspired some rethinking and alternative approaches within the XR industry. Full-featured AR glasses face technological challenges such as nuanced optical and display systems, device bulk, and cost. So going back to the drawing board in search of modalities that appeal to larger markets, some XR players came up with a different approach: lower-immersion smart glasses.

Meta is credited with sparking and validating this approach with Ray-Ban Meta Smartglasses. The device has sold 2 million+ lifetime units as of this writing, driven by a stylish form factor and toned-down AR features. In fact, they have no display system at all, relying instead on camera inputs that inform audible outputs (a.k.a., multimodal) – all fueled by AI.

That brings us to AR’s force multiplier. AI will enable these non-display form factors to be functional and engaging. Intelligent assistants and situational awareness – even if delivered by audio – replace visuals as AR’s selling point in some cases. This will be followed by simple displays for flat visuals from Meta and others. In each case, the key is devices that are experientially meaningful, even if graphically underpowered. AI was the key to unlock this endpoint, led by Ray-Ban Meta Smartglasses. And the demand that Meta has validated attracts other tech giants to the table, including Apple and Google.

But while these nearer-term mass-market moves are underway, the above players have one eye on the longer-term future: more immersive AR glasses. This includes Meta Orion – currently in prototype phases, as well as Snap’s streamlined Specs launching next year. The latter will hit the market as Snap’s first consumer version of its lauded and erstwhile developer-only Spectacles Gen 5. It will be a key moment in beginning to scale tier-1 AR glasses.

As all the above consumer dynamics materialize, visually-rich headworn AR has found traction in the enterprise. For example, it helps IT field reps operate with greater speed and effectiveness through line-of-sight guidance and remote support. Similar service, maintenance, and assembly use cases exist across high-value verticals – from agriculture to aerospace.

Speaking of enterprise adoption, it not only happens in a B2B sense but with B2B2C. We’re talking consumer endpoints such as games, entertainment, marketing, and commerce. The technology to create and support these functions is adopted by developers and brands who lean into AR as an interactive touchpoint with their customers or marketing targets.

But how do all these dynamics translate to revenue? That’s what we’ll quantify throughout this report…

The fastest and most cost-efficient way to get access to this report is by subscribing to ARtillery PRO (Startup tier or higher for forecast access). You can also purchase it a la carte.

ARtillery Intelligence follows disciplined best practices in market sizing and forecasting, developed and reinforced through its principles’ 20 years in research and intelligence in tech sectors. This includes the past 10 years covering AR & VR as a primary focus.

This report focuses on revenue projections in various sub-sectors and product areas. ARtillery Intelligence has built financial models that are customized to the specific dynamics and unit economics of each. These include variables like unit sales, company revenues, pricing trends, market trajectory, and several other micro and macro factors that ARtillery Intelligence tracks.

This approach primarily applies a bottom-up forecasting methodology, which is secondarily vetted against a top-down analysis. Together, confidence is achieved through triangulating revenues and projections in a disciplined way. More about ARtillery Intelligence’s market-sizing methodology can be seen here and more on its credentials can be seen here.

Unless specified in its stock ownership disclosures, ARtillery Intelligence has no financial stake in the companies mentioned in its reports. The production of this report likewise wasn’t commissioned. With all market sizing, ARtillery Intelligence remains independent of players and practitioners in the sectors it covers, thus mitigating bias in industry revenue calculations and projections. ARtillery Intelligence’s disclosures, stock ownership, and ethics policy can be seen in full here.

Checkout easily and securely.

Ask us anything