What’s the state of spatial computing? As we enter a new year, we embark on our annual exercise of defining the sector, its players, events, and trajectory. As for findings and highlights, the collective grouping of subsectors known as XR continues to push forward and invest tens of billions per year to realize self-centric versions of a spatial future.

One byproduct of this process is mixed reality’s elevated status as a new standard in VR, thanks to Meta Quest 3 and 3s. Meta isn’t first to market with mixed reality, but it’s combined the modality with the element of affordability. Along with this trend, HD color passthrough cameras broaden VR use cases and utility. They also advance AR, which can piggyback on the more mature and penetrated VR market.

Meanwhile, Ray-Ban Meta Smartglasses (RBMS) set the bar for headworn devices that are supported by AI. Among other advantages, this limits reliance on graphical dimensionality as a selling point. They rather rely on relevant information delivery such as personal

alerts, social signals, shopping & commerce, and real-world object recognition. This utility is met with the style and wearability that’s possible when you sidestep AR optical and display systems.

Then there’s Meta Orion. Though only a working prototype, it has cracked the code on achieving both a visually-robust UX and style/wearability. Now, Meta must spend years cracking another code: marketing an Orion-like product for less than $10,000 – the device’s current per-unit cost. But it has meanwhile demonstrated what’s technically possible in AR today.

Though many believe all the above approaches will someday meet in the middle for an ultimate XR device, we believe they’ll continue to develop along parallel tracks. They’ll be purpose built for varied use cases that map to their strengths – for the same reason you use a laptop and a smartphone, versus trying to do everything on a tablet. This multi-track approach also maximizes Meta’s market opportunity amidst a challenged XR adoption environment.

But it’s not just about Meta. Like Orion, Apple Vision Pro achieves the extent of what’s possible in spatial computing today – albeit a vastly different approach to augmentation. But unlike Orion, Vision Pro is available today, rather than sitting behind locked doors for internal use only. And though Vision Pro’s sales have disappointed, Apple admits that it’s “not a mass market product.” Moreover, Apple is playing a long game with Vision Pro as the first step towards its massive and inherently-advantaged spatial ambitions.

Meanwhile, mobile AR leader Snap continues to make strong moves in headworn AR. Its latest Spectacles raise the bar for commercially-available (though only for developers at this stage) AR glasses. And in a similar device class for optical seethrough AR (definitions are detailed in this report), we continue to see compelling hardware from Xreal. Though it doesn’t achieve dimensional AR like Spectacles and Orion, Xreal nails a simple and relatable use case: virtual private displays for entertainment & gaming.

Google and Samsung have also (re)entered the XR race, and have done so together. Android XR will be first available on Samsung headsets. This could be formidable, given Google’s AI capabilities in Gemini, which are infused in Android XR. Like Apple, Google’s platform position also offers advantages, such as bringing legions of existing Android apps into XR.

Speaking of platforms, it’s not just about devices. With all the above, a spatial stack lies beneath. This involves a cast of supporting roles like processing (Qualcomm), creation (Adobe), and dev tools (Niantic). And while headworn XR continues to evolve, Mobile AR is here today on about 3 billion devices.

Lastly, hanging over all the above are two little letters: AI. On one level, generative AI aids XR experience creation, thus streamlining developer workflows. On another level, it redefines user interfaces and inputs for XR devices ranging from smart glasses to mixed reality headsets. This is already happening.

So how is all of this coming together? What are these diverging and developing XR device categories? And who’s best positioned in the spatial spectrum? We’ll tackle these questions and others in this report series through numbers and narratives.

The fastest and most cost-efficient way to get access to this report is by subscribing to ARtillery PRO.

This report highlights ARtillery Intelligence viewpoints, gathered from its daily in-depth market coverage. To support narratives, data are cited throughout the report. These include ARtillery Intelligence’s original data, as well as that of third parties. Sources are linked or attributed in each case.

For market sizing and forecasting, ARtillery Intelligence follows disciplined best practices, developed and reinforced through its principles’ 20 years in tech-sector research and intelligence. This includes the past 10 years covering AR & VR exclusively, as seen in research reports and daily reporting.

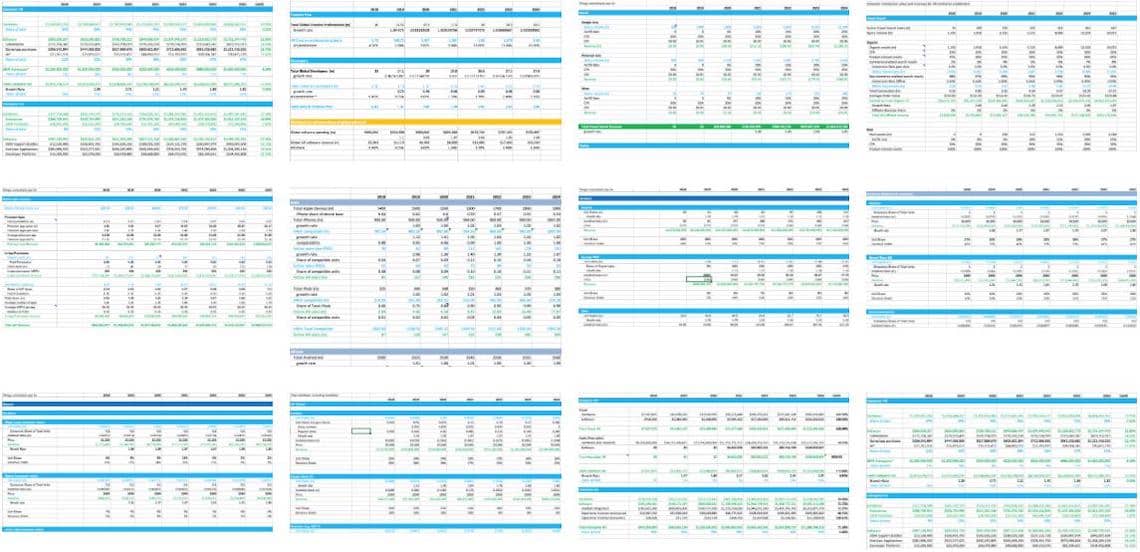

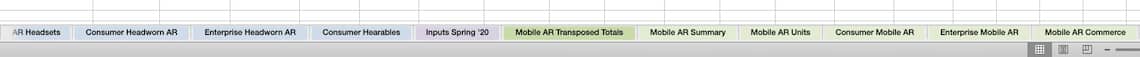

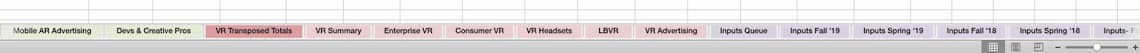

This approach primarily applies a bottom-up forecasting analysis, secondarily vetted against a top-down analysis. Together, confidence is achieved through triangulating figures in a disciplined way. More about our methodology can be seen here, and market-sizing credentials can be seen here.

Unless specified in its stock ownership disclosures, ARtillery Intelligence has no financial stake in the companies mentioned in its reports. The production of this report likewise wasn’t commissioned. With all market sizing, ARtillery Intelligence remains independent of players and practitioners in the sectors it covers, thus mitigating bias in industry revenue calculations and projections. ARtillery Intelligence’s disclosures, stock ownership, and ethics policy can be seen in full here.

Checkout easily and securely.

Editor’s note: While most ARtillery Intelligence reports are available for individual purchase, this report is available exclusively for ARtillery Pro subscribers. Sign up here.

Ask us anything