In AR’s early stages, a few areas stand out for their monetization potential and business case. We’ve examined such areas in past reports, including AR’s role in enterprise productivity, and its use in helping consumer brands add dimension to their product marketing.

But another branch of AR has potentially greater experiential impact for consumers, and revenue impact for brands: immersive shopping. Related to – but separate from – AR advertising, this is when AR is used as a tool to visualize and contextualize products for more informed consumer purchases.

This is a subset of AR that we call camera commerce. It comes in a few flavors, including visualizing products on “spaces and faces,” to see if they fit. It also includes visual search, which involves pointing one’s smartphone camera at a given product to get informational, identifying or transactional overlays.

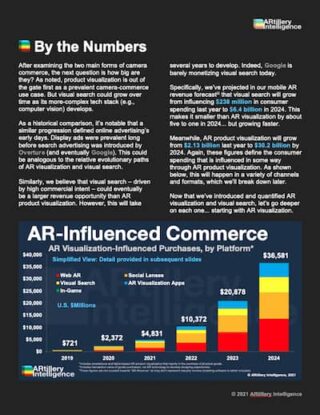

Among these formats, product visualization is out of the gate first and has the most traction. Visual search is meanwhile less mature due to more complex technological underpinnings like computer vision. But it has greater monetization potential, given the high-intent use case of actively scanning items.

In each case, AR brings additional context and confidence to product purchases. And this value has been elevated during a pandemic when eCommerce itself has inflected. AR has brought back some of the product dimension and tactile detail that’s been taken away from consumers during retail lockdowns.

Beyond the pandemic, AR brings sustained value as a shopping tool as it’s proven to boost conversions in several eCommerce scenarios. For example, Shopify reports that products that offer 3D and AR visualization achieved 94 percent greater conversions on average than non-AR equivalents.

In addition to boosting conversion rates, the informed purchases that AR engenders can reduce return rates. For example, SeekXR reports that AR-guided purchases have 25 percent fewer returns than non-AR benchmarks. This is a welcome benefit for online merchants who suffer from margin-depleting product returns.

Beyond online shopping, camera commerce could find a home in brick & mortar retail. Specifically, it could develop as a utility for in-aisle interactions such as evoking product details. This could also support “touchless” retail shopping if epidemiological health measures sustain into the post-Covid era.

Synthesizing these factors – along with AR’s broader growth and cultural acclimation – ARtillery Intelligence estimates that AR will influence $36 billion in consumer spending by 2024. This means that AR will play a role in some part of the consideration funnel for these transactions.

But how will this all come together? What cultural and technological barriers loom? And who’s doing what? We’ll tackle these questions throughout this report, including numbers, narratives and case studies for camera commerce. The goal, as always, is to empower you with a knowledge edge.

The fastest and most cost-efficient way to get access to this report is by subscribing to ARtillery PRO. You can also purchase it a la carte.

This report highlights ARtillery Intelligence’s viewpoints, gathered from its daily in-depth coverage of spatial computing. To support the narrative, data are cited throughout the report. These include ARtillery Intelligence’s original data, as well as that of third parties. Data sources are attributed in each case.

For market sizing and forecasting, ARtillery Intelligence follows disciplined best practices, developed and reinforced through its principles’ 15 years in tech sector research and intelligence. This includes the past 4 years covering AR & VR exclusively, as seen in research reports and daily reporting.

Furthermore, devising these figures involves the “bottom-up” market-sizing methodology, which involves granular ad revenue dynamics such as campaign pricing and spending. More about ARtillery Intelligence methodology can be seen here, and market-sizing credentials can be seen here.

ARtillery Intelligence has no financial stake in the companies mentioned in this report, nor received payment for its production. With respect to market sizing, ARtillery Intelligence remains independent of players and practitioners in the sectors it covers, thus mitigating bias in industry revenue calculations and projections. Disclosure and ethics policy can be seen in full here.

Checkout easily and securely.

Ask us anything