Though we spend ample time examining consumer-based AR endpoints, greater near-term impact is seen today in the enterprise.

This takes many forms including data visualization in corporate settings, or software to create customer-facing AR experiences for brands. But the greatest area of enterprise AR impact today is realized in industrial settings.

These industrial use cases include AR visualization to support assembly and maintenance in manufacturing facilities. The idea is that AR’s line-of-sight orientation can guide front-line workers. Compared to the “mental mapping” they must do with 2D instructions, line-of-sight support makes them more effective.

This effectiveness results from AR-guided speed, accuracy and safety. These micro efficiencies add up to worthwhile bottom-line impact when implemented at scale in industrial operations. Macro benefits meanwhile include lessening job strain and the “skills gap,” which can lead to preserving institutional knowledge.

For example, AR leader PTC reports up to 40 percent improvements in new employee productivity, 30 percent greater first-time fix rates, 50 percent reductions in training costs, and 25 percent reductions in materials scrap.

But it’s not all good news. Though all of these advantages are valid, it’s challenging to get to the point of realizing them. Practical and logistical barriers stand in the way, such as organizational inertia, politics, change management and fear of new technology among stakeholders like front-line workers.

The biggest symptom of these stumbling blocks is the dreaded “pilot purgatory.” As its name suggests, and as you may have heard in AR industry narratives, this is when AR is adopted at the pilot stage, but never progresses to full deployment. It’s the biggest pain point in industrial AR today.

In the past, ARtillery Intelligence has identified the sources and solution areas for pilot purgatory as the “3 Ps.” Comprising people, product and process, they’re the top areas where effective AR implementation strategies should focus.

With that backdrop, we continue the narrative in this report with an update on the enterprise AR opportunity, including new ARtillery Intelligence market sizing data. Moreover, we devote the bulk of this report to “show rather than tell.” We’ll do this through several case studies that demonstrate enterprise AR best practices and business cases.

To adequately represent these factors, we’ve reached out to leading enterprise AR players to collect their top case studies. We’ve then relayed these through our own lens and analytical rigor. We’ve prioritized case studies that have quantifiable results, actionable takeaways, and a wide variety of business verticals and use cases.

The goal in all of the above is to reveal the why and how of enterprise AR. Through the lens of industry best practices, why should enterprises invest in AR? And how should it be optimally implemented? The name of the game is to set up enterprise AR to succeed by deploying it from a position of confidence and knowledge.

The fastest and most cost-efficient way to get access to this report is by subscribing to ARtillery PRO. You can also purchase it a la carte.

This report highlights ARtillery Intelligence’s viewpoints, gathered from its daily in-depth coverage of spatial computing. To support the narrative, data are cited throughout the report. These include ARtillery Intelligence’s original data, as well as that of third parties. Data sources are attributed in each case.

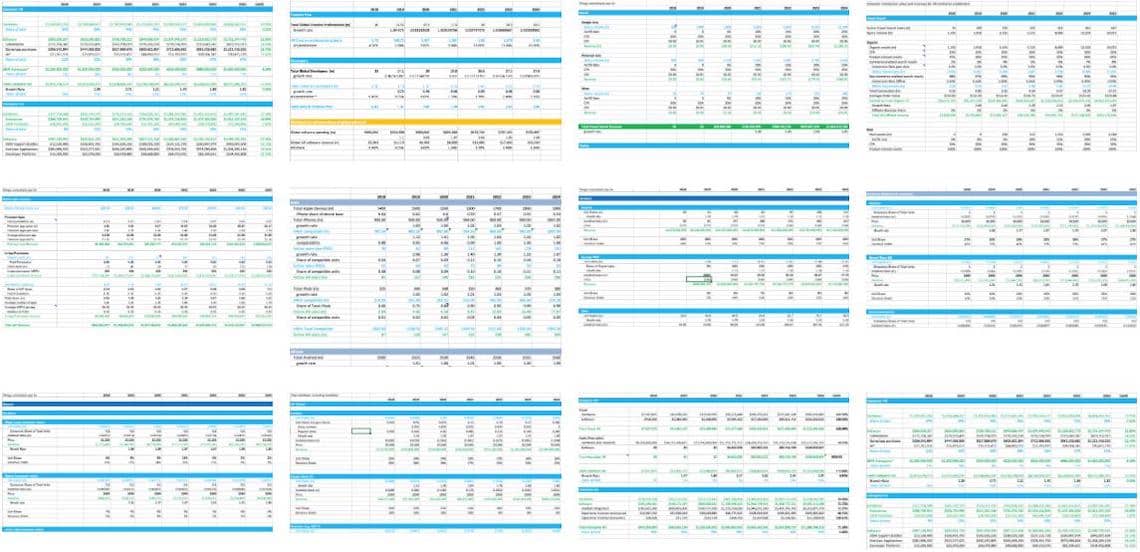

For market sizing and forecasting, ARtillery Intelligence follows disciplined best practices, developed and reinforced through its principles’ 15 years in tech sector research and intelligence. This includes the past 4 years covering AR & VR exclusively, as seen in research reports and daily reporting.

Furthermore, devising these figures involves the “bottom-up” market-sizing methodology, which involves granular ad revenue dynamics such as campaign pricing and spending. More about ARtillery Intelligence methodology can be seen here, and market-sizing credentials can be seen here.

ARtillery Intelligence has no financial stake in the companies mentioned in this report, nor received payment for its production. With respect to market sizing, ARtillery Intelligence remains independent of players and practitioners in the sectors it covers, thus mitigating bias in industry revenue calculations and projections. Disclosure and ethics policy can be seen in full here.

Checkout easily and securely.

Ask us anything