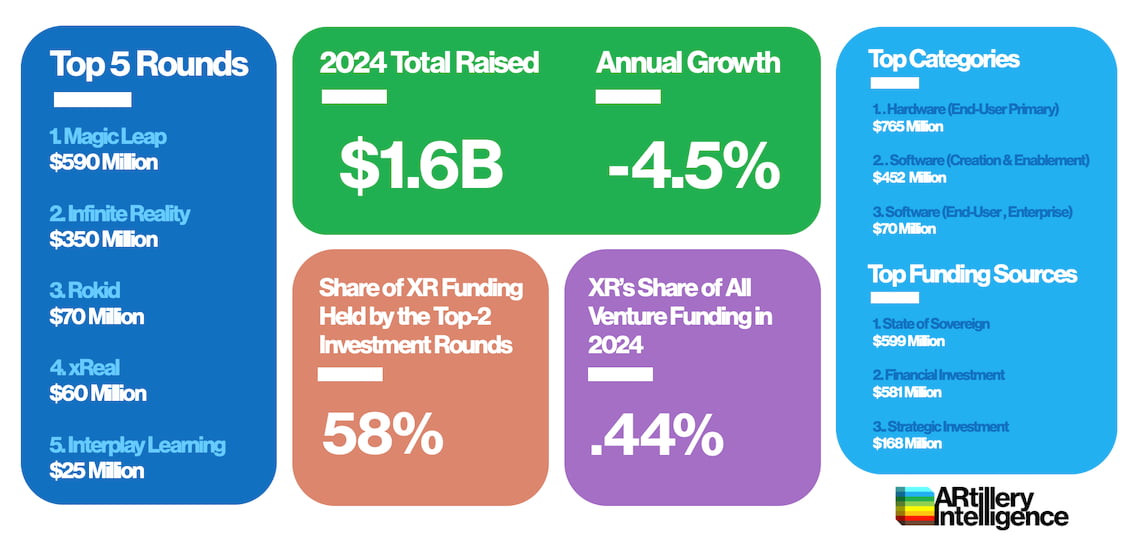

One health indicator in any tech sector is the venture funding that flows into it. It signals confidence levels from the stakeholders who have the most to gain – and lose – from it. Due to those high stakes, good investors tend to have among the deepest knowledge of a given tech category. Through the process of diligence, they’re forced to know it intimately. Therefore, in the aggregate, the funding they commit to a given sector can be a reliable confidence signal. Beyond confidence, venture investing itself fuels the sectors that it enters – thereby accelerating growth.

The XR industry is no exception to these dynamics. Its venture-funding ebs and flows map to its fluctuating health. Within the current era of XR – starting with Meta’s 2014 acquisition of Oculus – we’ve seen a few such boom & bust cycles. The first was the circa-2017 period of elevated investment, which led to a shakeout and market correction from 2018-2020. Things picked back up in 2021, driven by a combination of the Covid software boom and the phenomenon we call “metaverse mania.”

The correction that then followed was amplified by a few factors. The first was the hangover from the Covid software boom, which dampened venture funding in general. The second was the rapid rise of AI, which sucked all the air out of the room in terms of investor interest. That trend continues to this day.

As all this unfolded, the fall of the metaverse dragged XR down with it, given its association and adjacency. This puts XR startups in a challenging spot, as reported by several that are currently fundraising. For example, Lynx CEO Stan Larroque characterized the funding environment in mid-2024 as “excruciating.”

But to quantify the XR environment more precisely, how much venture funding flows into it, and how does that break down by category, stage, and deal size? This report quantifies these variables through original data, using full-year 2024 as a baseline. But rather than a standalone analysis, this represents a new series. The goal is for insights to elevate with each annual exercise, including longitudinal perspective and trend data. Until then, we’ve aggregated third-party figures for trending data that precede 2024.

This report unpacks and analyzes the results, pursuant to a reliable reading on XR sector health.

The fastest and most cost-efficient way to get access to this report is by subscribing to ARtillery PRO. You can also purchase it a la carte.

ARtillery Intelligence follows disciplined best practices in market sizing and forecasting, developed and reinforced through its principles’ 20 years in research and intelligence in the tech sector. This includes the past 10 years covering AR & VR as a primary focus.

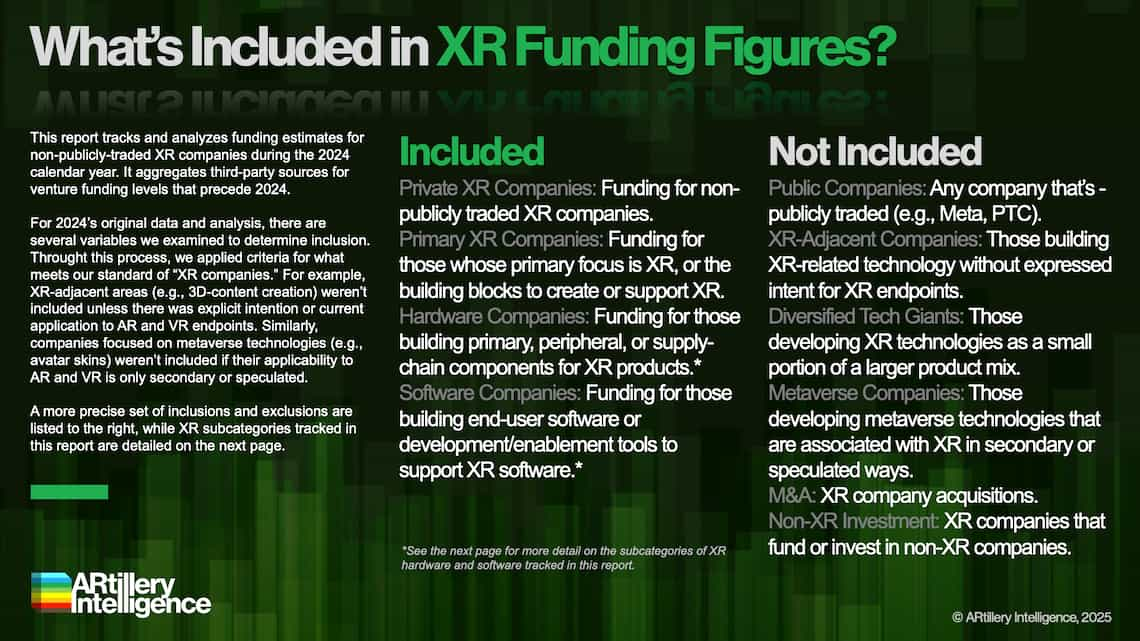

This report focuses on XR funding. To accomplish this, ARtillery Intelligence developed a tracking mechanism known as Funding Watch to monitor XR funding activity throughout the year. Starting in calendar-year 2024, this includes a combination of automated and manual scanning of public sources that report funding activity. It then processes, segments, and analyzes resulting data for the production of this report. Given the knowledge that a portion of funding activity is unreported, we extrapolate an additional dollar amount to cover the gap. For data that precedes 2024 – used in trending analysis, for example – we utilized third-party resources that report annual XR funding data.

Beyond input data and calculations, the narrative insights that populate this report flow from ARtillery Intelligence’s XR knowledge position and analytical license. More about our methodology can be seen here, and market-sizing credentials can be seen here.

Unless specified in its stock ownership disclosures, ARtillery Intelligence has no financial stake in the companies mentioned in its reports. The production of this report likewise wasn’t commissioned. With all market sizing, ARtillery Intelligence remains independent of players and practitioners in the sectors it covers, thus mitigating bias in industry revenue calculations and projections. ARtillery Intelligence’s disclosures, stock ownership, and ethics policy can be seen in full here.

Checkout easily and securely.

Ask us anything