Mobile AR Global Revenue Forecast: 2024-2029

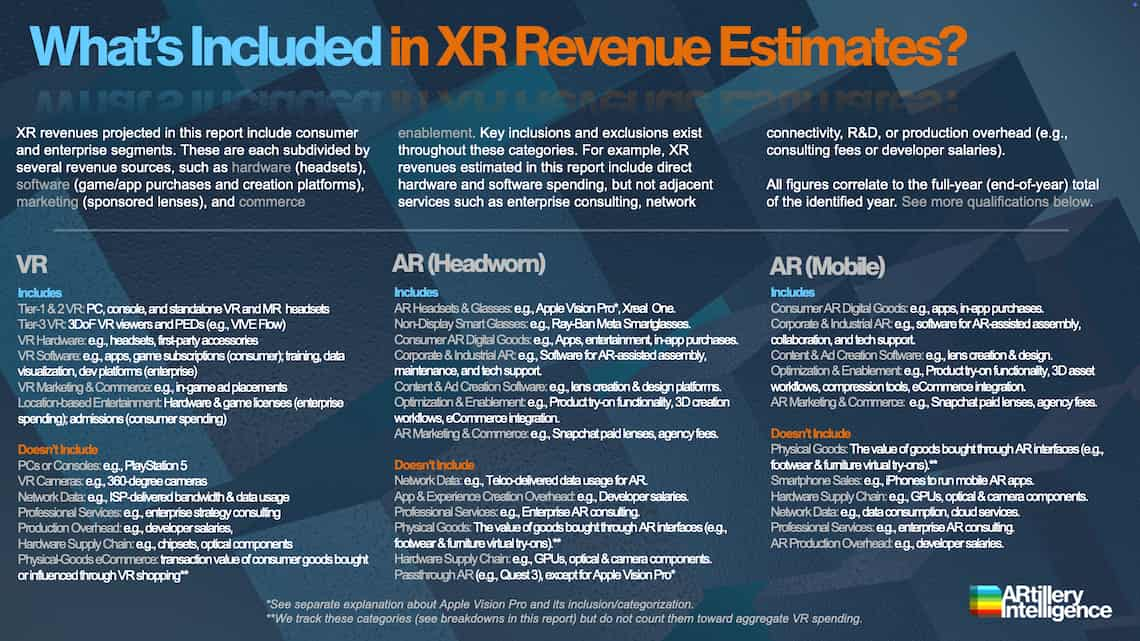

Like many research & intelligence firms, one of the things that ARtillery Intelligence does is market sizing. A few times per year, we go into isolation and bury ourselves deep in financial modeling. This exercise takes the insights and observations we accumulate throughout the year and synthesizes them into hard numbers for the current and future spatial computing industry (methodology details here).

In covering spatial computing for ten years, our sector knowledge base and perspective continue to expand. That occurs on several levels, including insight and access to insider information, all of which informs our forecast models and inputs. Further reinforcing that knowledge position, the daily rigors of editorial production at our sister publication AR Insider emboldens our market insights. It also offers an invaluable asset for market-sizing work: access.

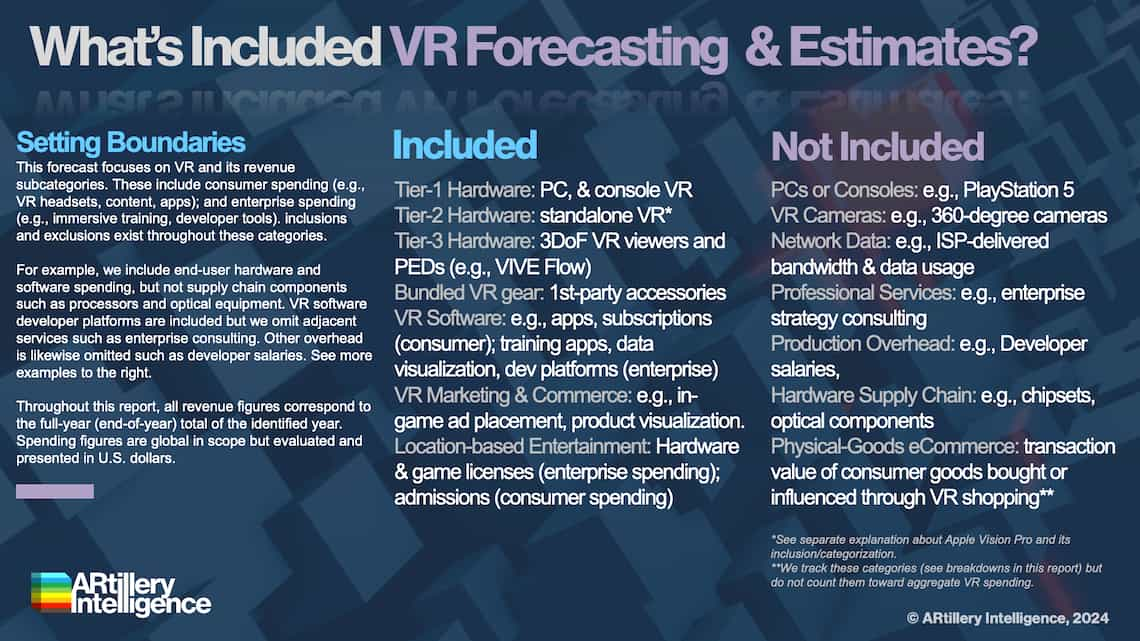

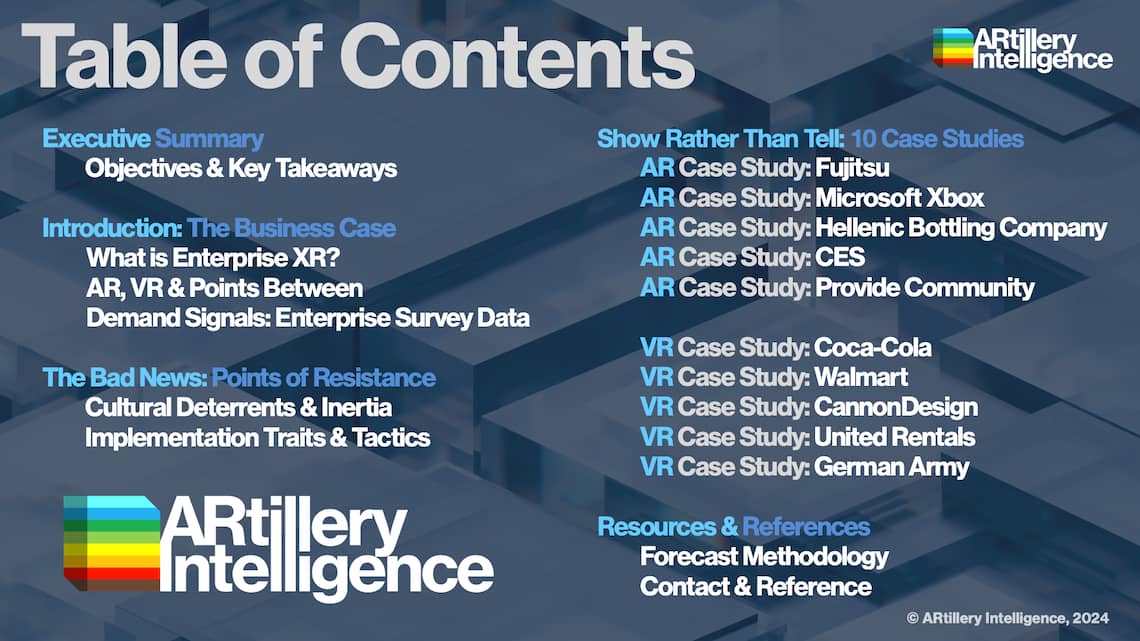

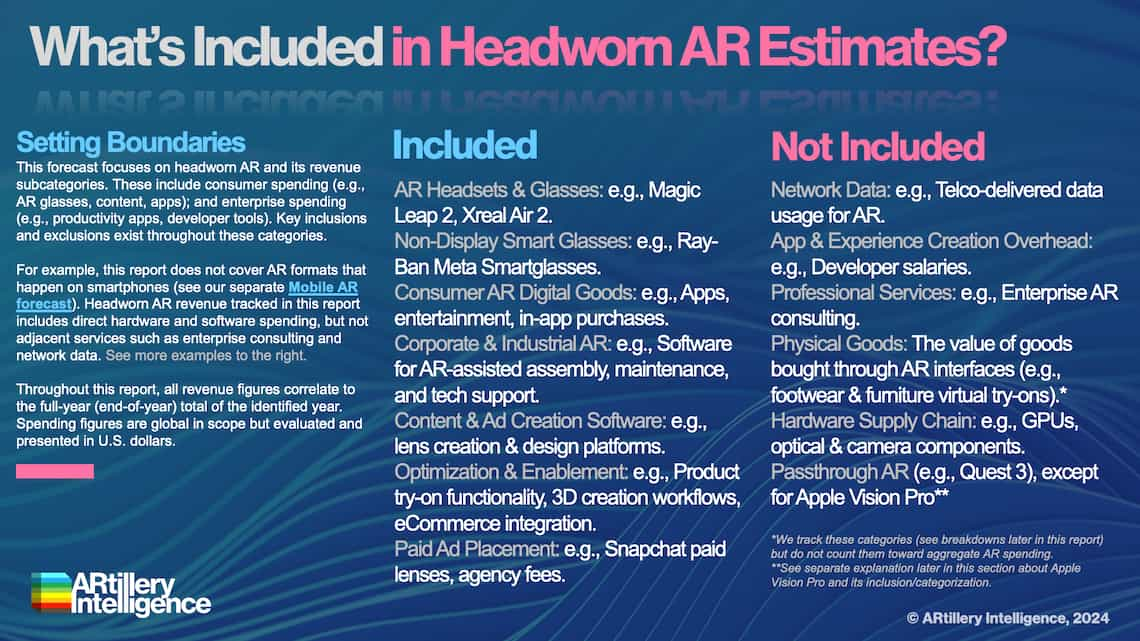

Beyond a knowledge position and market-sizing process, the focus of these forecasts likewise continues to evolve. Our first market forecast seven years ago examined AR, VR, and all their revenue subsegments (collectively, XR). We still produce that broader forecast, but also do separate forecasts for headworn AR, mobile AR, and VR. Though they share technical underpinnings, their nuanced market dynamics deserve deeper and focused treatment.

We continue to double down on that segmentation by focusing this report on mobile AR. Given its leading revenue position among AR segments, and its hardware installed base, it compels its own focused analysis. This allows us to go deeper into key revenue sources like consumer, enterprise productivity, brand marketing, and commerce enablement. We’ll do the same later this year for headworn AR and VR.

So what did we find out? Starting at the top, Mobile AR revenue is projected to grow from $10.04 billion in 2024 to $15.45 billion in 2029. Among other things, that means mobile AR revenue exceeds headworn AR, as it piggybacks on 3.62 billion global smartphones.

But that installed hardware base doesn’t always translate to revenue. For example, mobile AR consumer spending is relatively low, including in-app purchases in Pokémon Go. The game still has decent traction but it’s an outlier as most consumers don’t pay for AR experiences. Those that do mostly execute in-app purchases – an established and comfort-advantaged behavior from its footing in mobile gaming. But consumers largely aren’t buying AR apps.

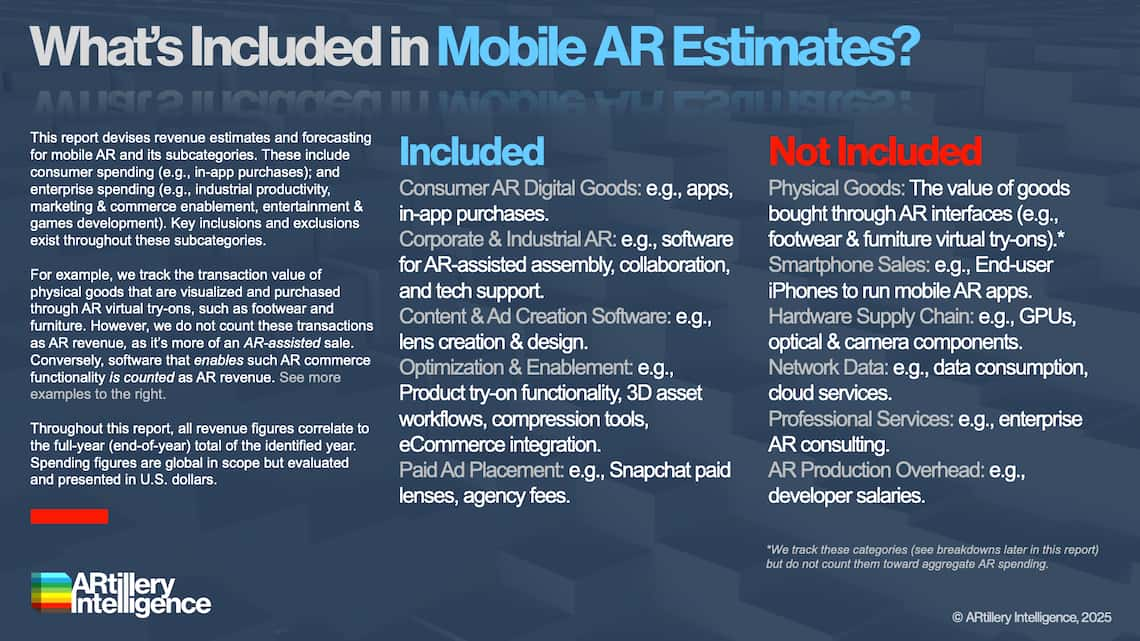

Consumers are however buying physical goods with the help of AR. This involves AR product try-ons that add dimension and consumer confidence in e-commerce. This has resonated with consumers, especially the camera-native generation Z. Brands and retailers have correspondingly adopted AR in their marketing, as it can demonstrate products with greater dimension. This brand spending is where a large portion of mobile AR revenue comes from.

That brand adoption also represents an area of AR spending we classify as B2B2C. It involves brands that utilize AR to create experiences for their customers or marketing targets. Put another way, most mobile AR usage today is brand-sponsored rather than consumer-purchased. This same B2B2C principle applies in other categories in this forecast, such as mobile AR media & games development.

Beyond B2B2C, there’s also B2B spending. This includes software that helps enterprises boost effectiveness or productivity. For example, AR can help IT services companies empower field reps to operate with greater speed and effectiveness through line-of-sight guidance. This use case holds the most promise in headworn AR but today remains more prevalent in mobile AR, due to smartphone ubiquity.

So how do these principles translate to revenue? That’s what we’ll quantify and qualify in this report…

The fastest and most cost-efficient way to get access to this report is by subscribing to ARtillery PRO (Startup tier or higher for forecast access). You can also purchase it a la carte.

ARtillery Intelligence follows disciplined best practices in market sizing and forecasting, developed and reinforced through its principles’ 20 years in research and intelligence in tech sectors. This includes the past 10 years covering AR & VR as a primary focus.

This report focuses on revenue projections in various sub-sectors and product areas. ARtillery Intelligence has built financial models that are customized to the specific dynamics and unit economics of each. These include variables like unit sales, company revenues, pricing trends, market trajectory, and several other micro and macro factors that ARtillery Intelligence tracks.

This approach primarily applies a bottom-up forecasting methodology, which is secondarily vetted against a top-down analysis. Together, confidence is achieved through triangulating revenues and projections in a disciplined way. More about ARtillery Intelligence’s market-sizing methodology can be seen here and more on its credentials can be seen here.

Unless specified in its stock ownership disclosures, ARtillery Intelligence has no financial stake in the companies mentioned in its reports. The production of this report likewise wasn’t commissioned. With all market sizing, ARtillery Intelligence remains independent of players and practitioners in the sectors it covers, thus mitigating bias in industry revenue calculations and projections. ARtillery Intelligence’s disclosures, stock ownership, and ethics policy can be seen in full here.

Checkout easily and securely.

Ask us anything