Mobile AR Usage & Consumer Attitudes, Wave 8

How do consumers feel about mobile AR? Who’s using it? How often? And what do they want to see next? Perhaps more importantly, what are non-users’ reasons for disinterest? And how should app developers build mobile AR experiences accordingly?

These are the questions we set out to answer. Working closely with Thrive Analytics, ARtillery Intelligence wrote questions to be fielded to more than 52,325 U.S. adults through Thrive’s established consumer survey engine. As the eighth wave of this mobile AR research, the results are in and we’ve synthesized the takeaways throughout this report.

This follows several ARtillery Intelligence monthly reports that examine various segments of, and developing use cases for, consumer AR experiences that happen on smartphones. Now a deeper view into consumer usage and attitudes validates those narratives while providing new dimension into mobile AR strategies and opportunities.

So what did we find out? At a high level, mobile AR usage has grown to 35 percent of U.S. adults. Many of these users experience AR through apps, such as those built on Apple’s ARKit and Google’s ARCore. But there’s greater engagement with lower-friction experiences such as “AR-as-a-feature.”

Mobile AR users also appear active and engaged, with 46 percent reporting that they use it at least weekly. The top app category is gaming, which we attribute to Pokémon Go’s sustained traction, even after it has gone a bit quiet in terms of press attention. But other categories such as AR shopping, social interaction, and visual search continue to make headway.

Beyond the positive results and demand signals outlined on the previous page, there are negative signs and areas for improvement. For example, mobile AR non-users report low likelihood of adopting, and an explicit lack of interest in the technology.

This disparity between current-user satisfaction and non-user disinterest continues to underscore a key challenge for AR: you need to experience it to see its benefits. But there’s little motivation for non-users to do so. This creates a classic “chicken & egg” dilemma that represents a core marketing challenge for AR.

Put another way, AR’s highly-visual and immersive format is a double-edged sword. It can create strong affinities and high engagement levels. But the visceral nature of its experience can’t be communicated to prospective users through traditional marketing, such as ad copy or even video.

The same chicken & egg challenge was uncovered in the corresponding VR consumer research that we published last month. This makes it a common challenge for immersive tech, though mobile AR is relatively advantaged by smartphone ubiquity. Still, it will take time and acclimation before AR reaches a more meaningful share of the population.

Meanwhile, there are strategies to accelerate that process and to build AR apps that align with consumer affinities. And these strategies will be a moving target as AR evolves from mobile – the predominant form factor today – to its endgame: headworn. We will end this report with data that quantify the early stages of this transition from handheld to headworn AR.

The fastest and most cost-efficient way to get access to this report is by subscribing to ARtillery PRO (Startup tier or higher for forecast access). You can also purchase it a la carte.

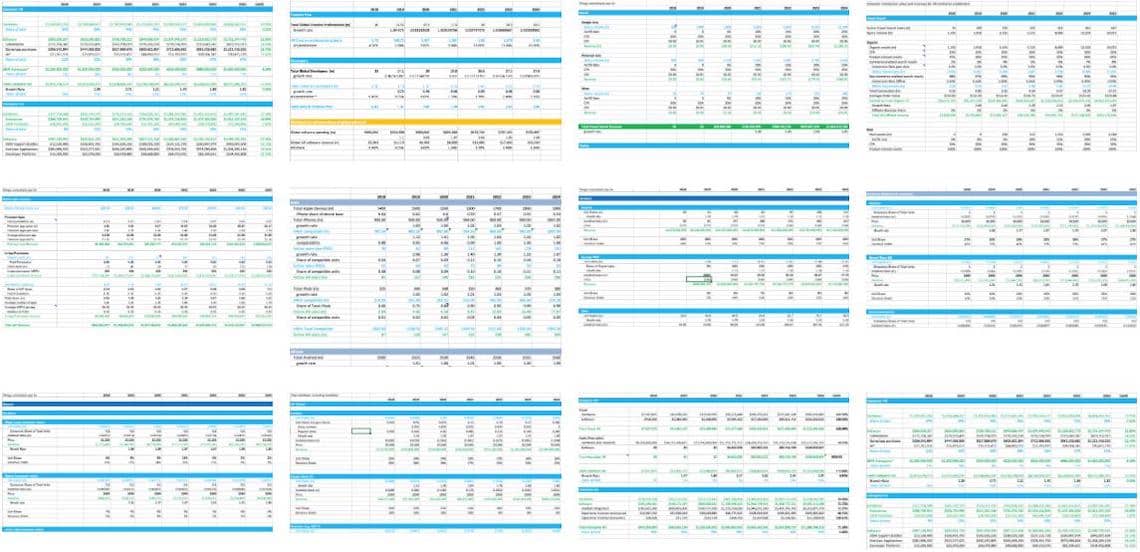

ARtillery Intelligence follows disciplined best practices in market sizing and forecasting, developed and reinforced through its principles’ 18 years in research and intelligence in tech sectors. This includes the past 8 years covering AR & VR as a primary focus.

ARtillery Intelligence has partnered with Thrive Analytics by writing the questions for the Virtual Reality Monitor consumer survey. These questions were fielded to more than 52,000 U.S. Adults. ARtillery Intelligence wrote this report, containing its insights and viewpoints on the survey results.

For market sizing and analysis, ARtillery Intelligence follows disciplined best practices, developed and reinforced through its principles’ 18 years in research and intelligence in the tech sector. This includes the past 8 years covering AR & VR exclusively, as seen in research and daily reporting.

Thrive Analytics likewise follows best practices in consumer research, developed over its long tenure as a consumer research firm. More details about the survey sample can be seen in this report’s introduction and more on ARtillery Intelligence research methodology can be read here.

More about ARtillery Intelligence’s market-sizing methodology can be seen here and more on its credentials can be seen here.

Unless specified in its stock ownership disclosures, ARtillery Intelligence has no financial stake in the companies mentioned in its reports. The production of this report likewise wasn’t commissioned. With all market sizing, ARtillery Intelligence remains independent of players and practitioners in the sectors it covers, thus mitigating bias in industry revenue calculations and projections. ARtillery Intelligence’s disclosures, stock ownership, and ethics policy can be seen in full here.

Checkout easily and securely.

Ask us anything