The latest original intelligence. Subscribers, log in for full access.

Monthly reports since 2017. Subscribers, log in for full access.

Latest

Latest

Archive

Archive

Latest

Latest

Archive

Archive

What’s coming up…

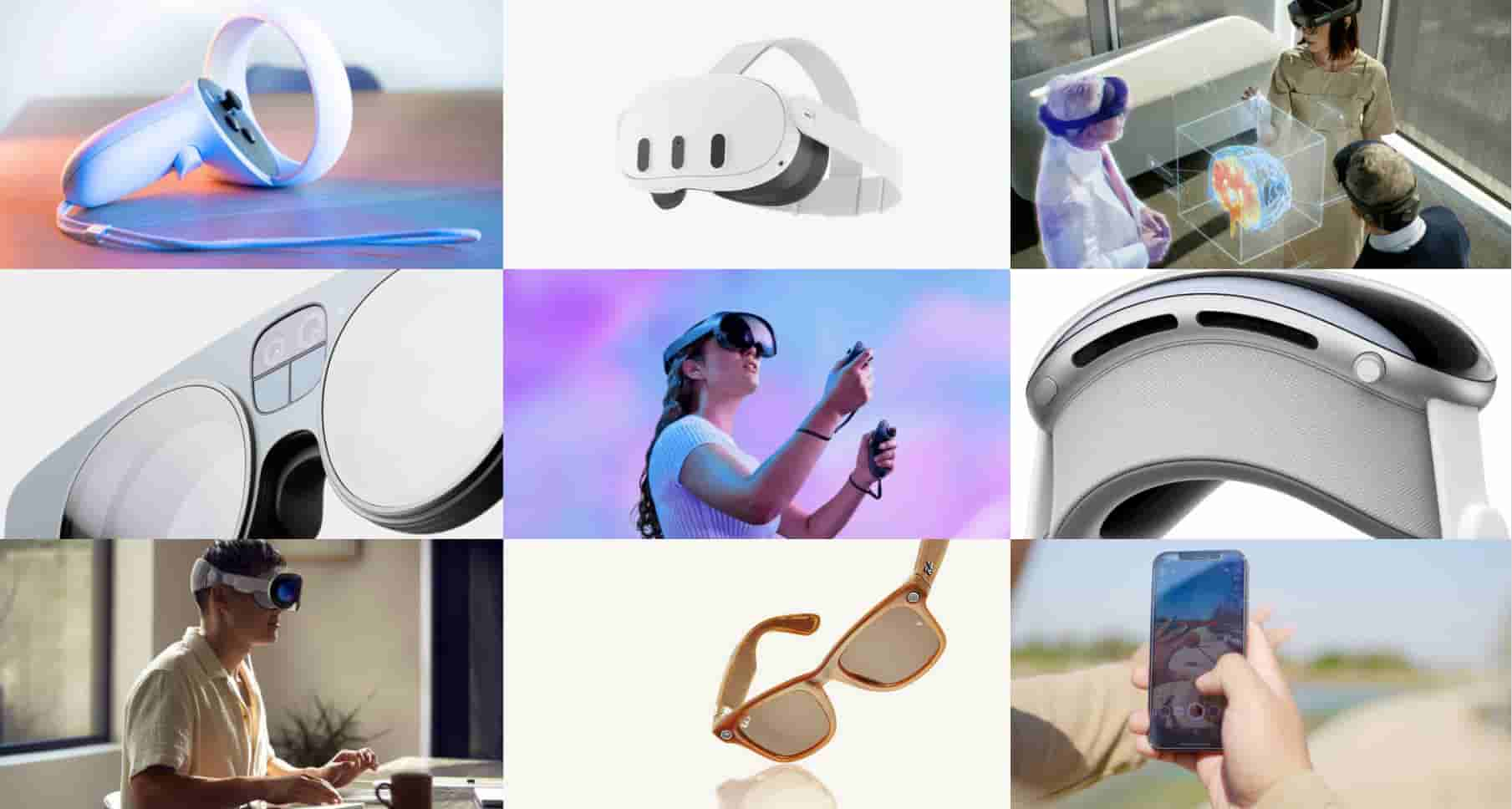

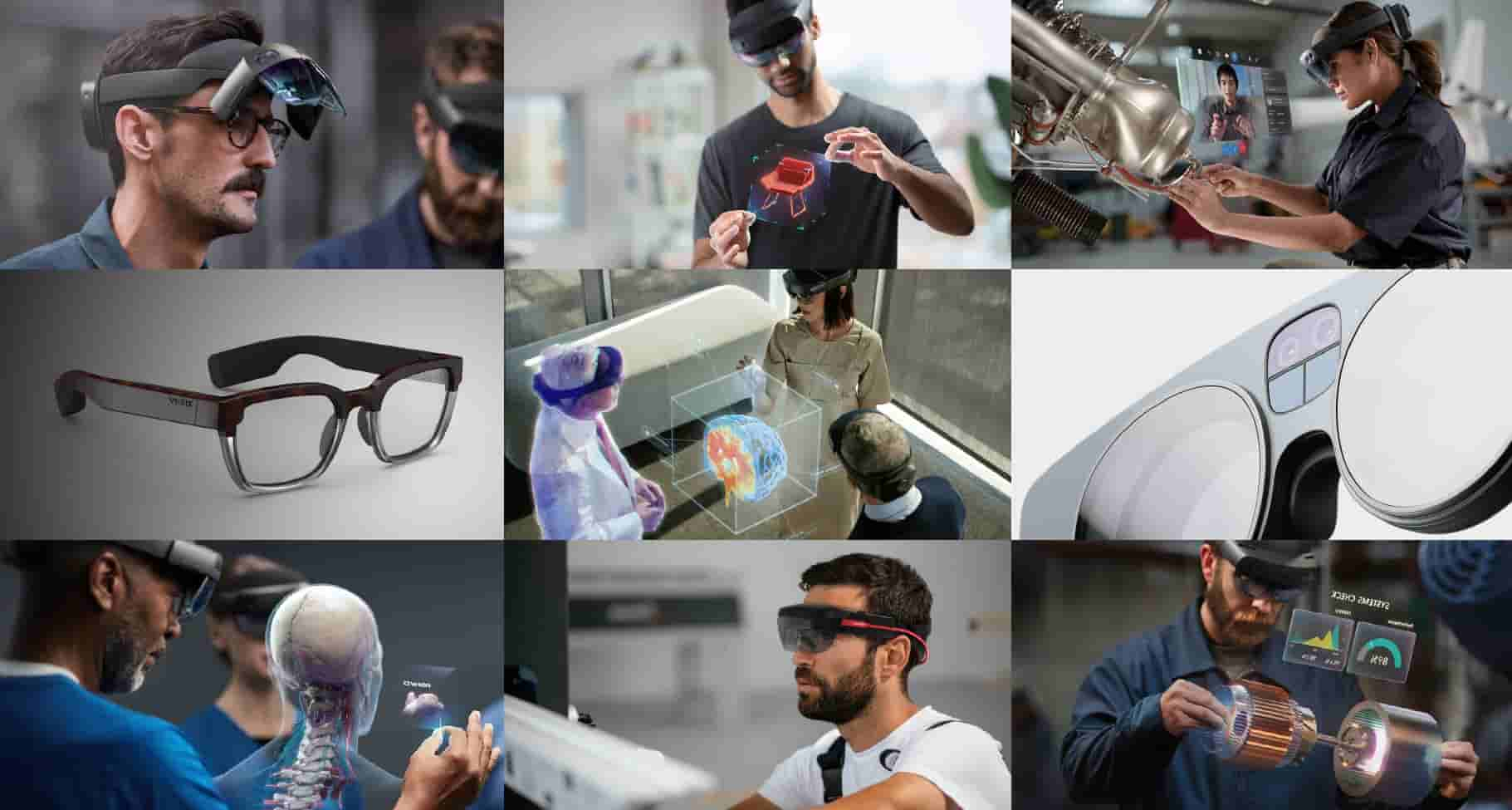

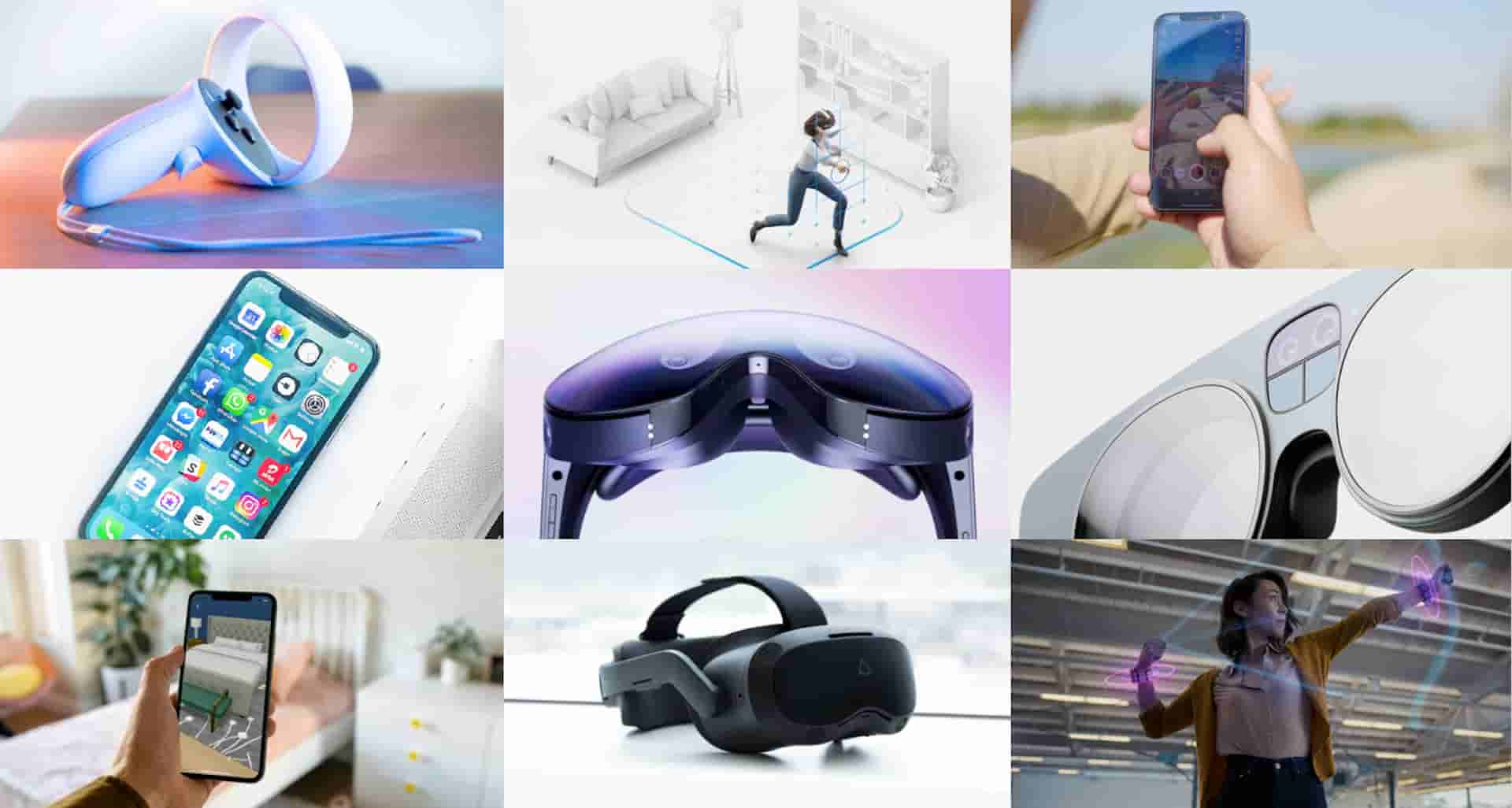

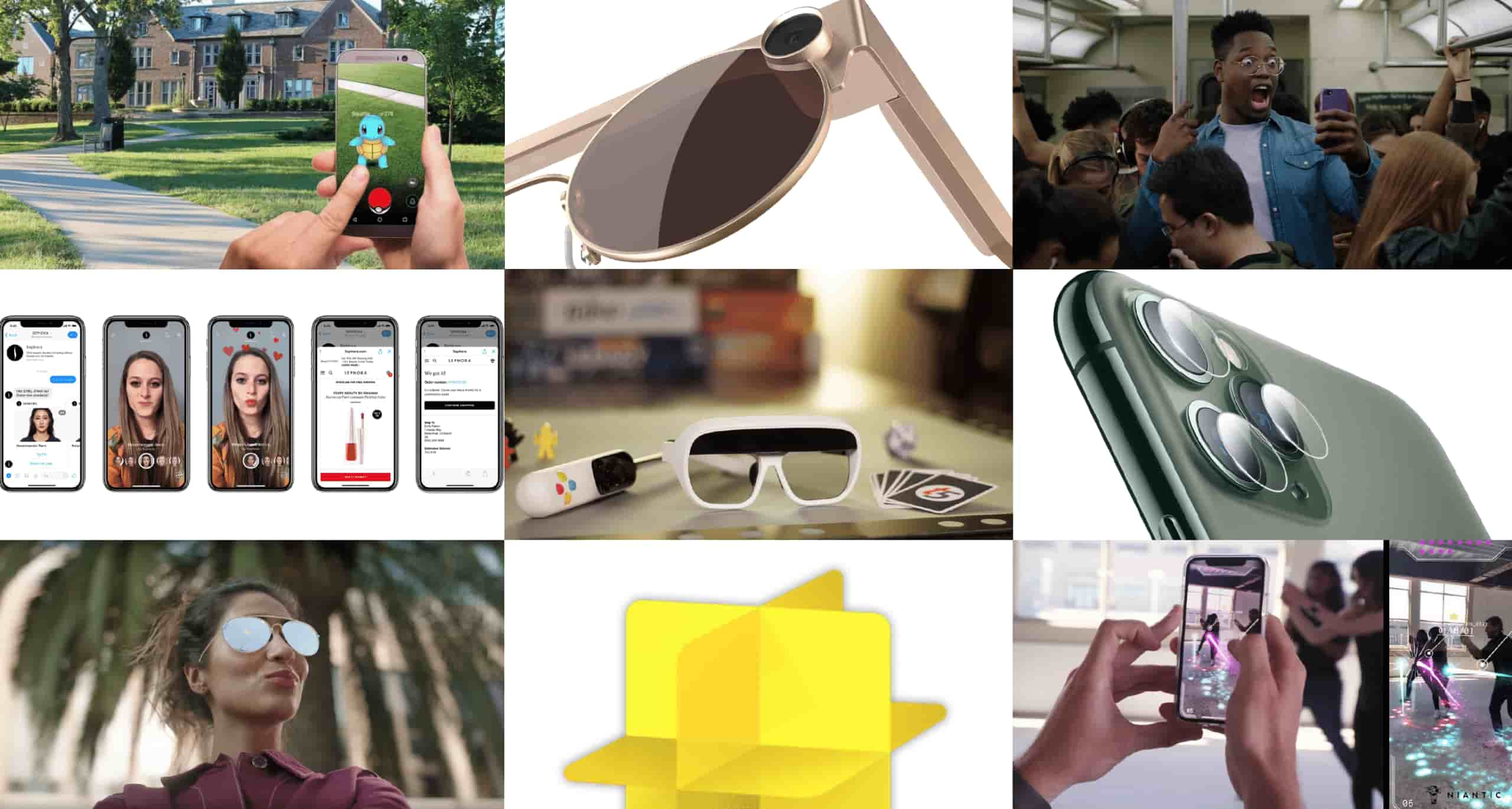

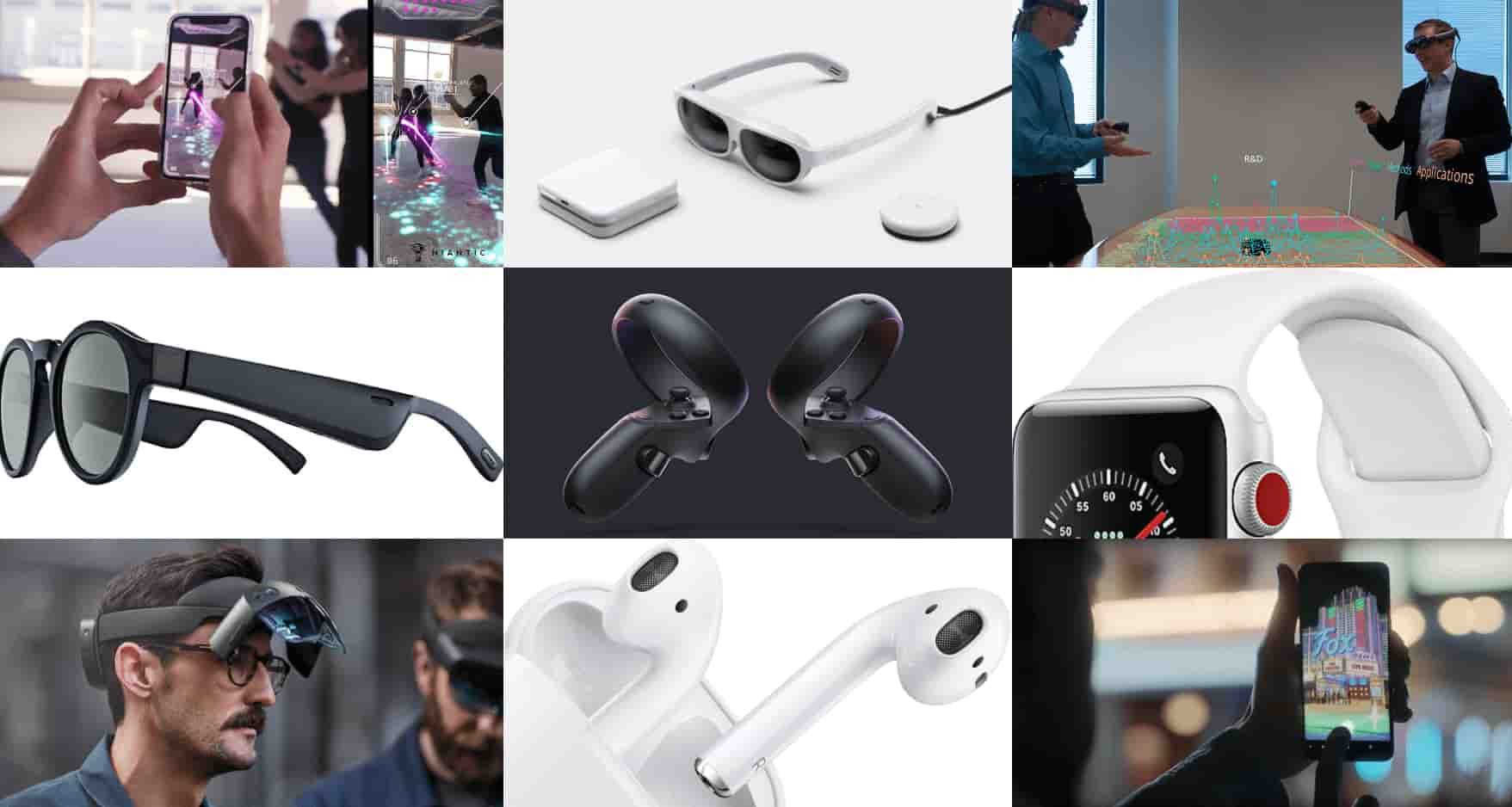

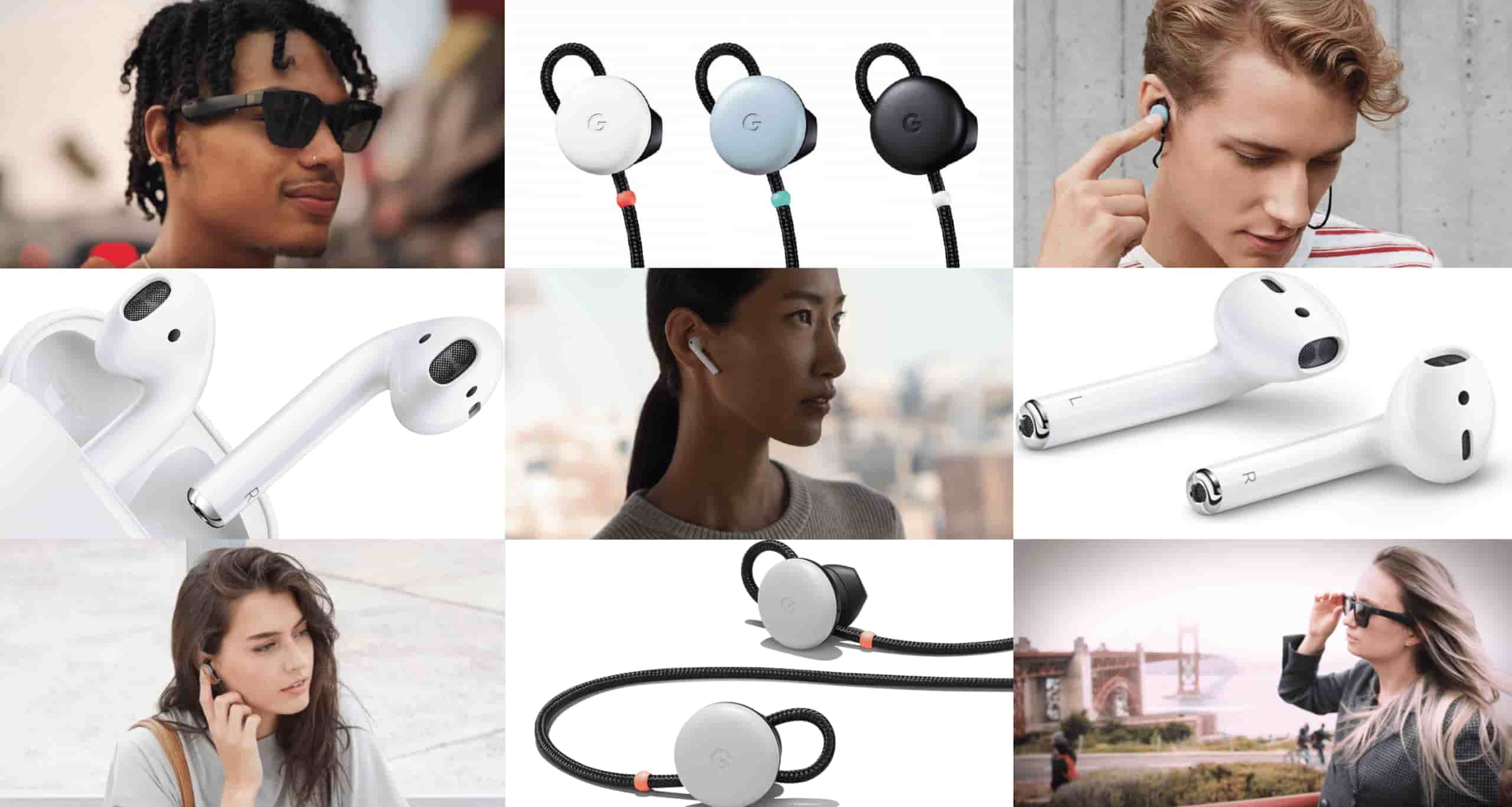

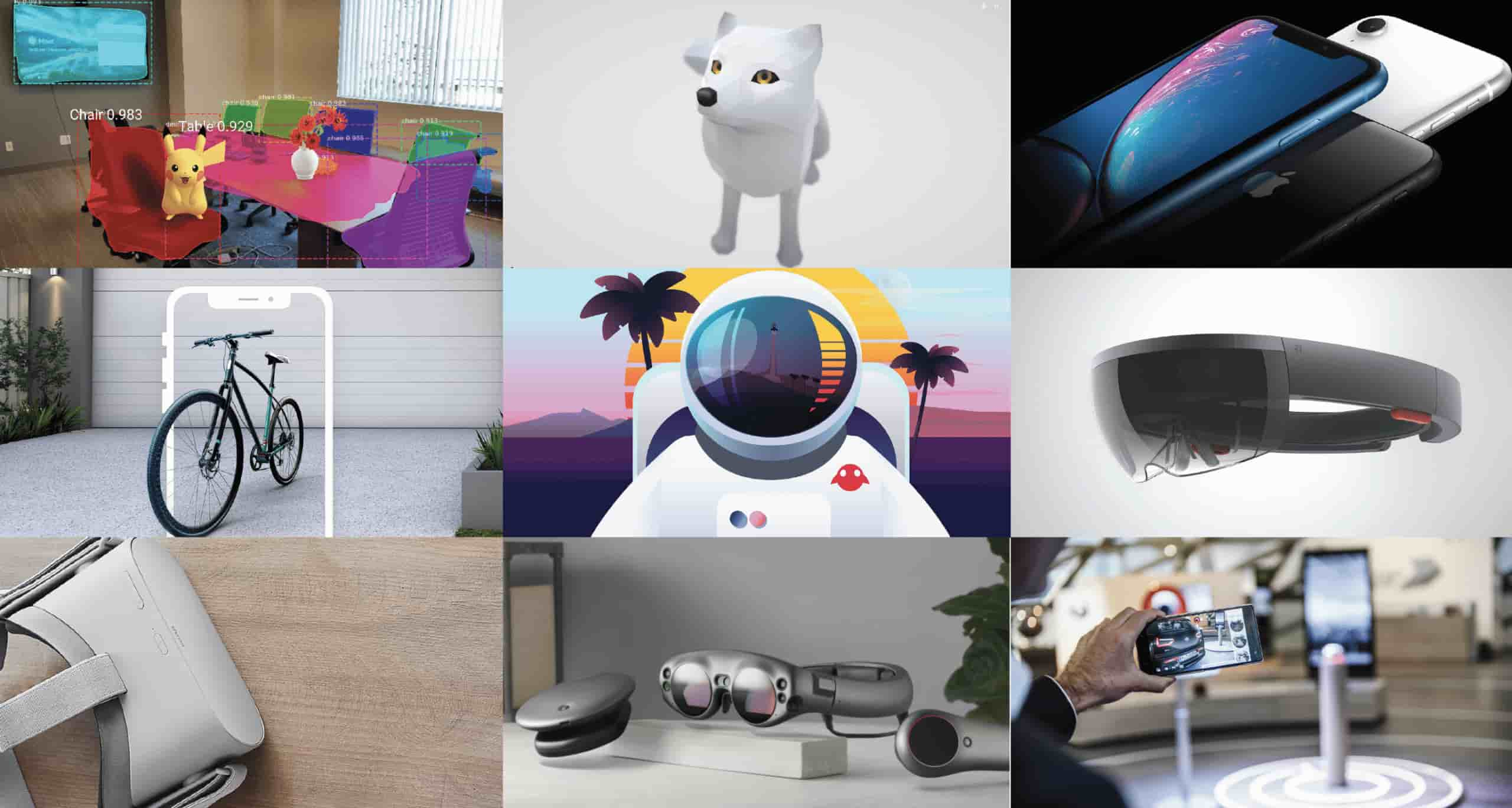

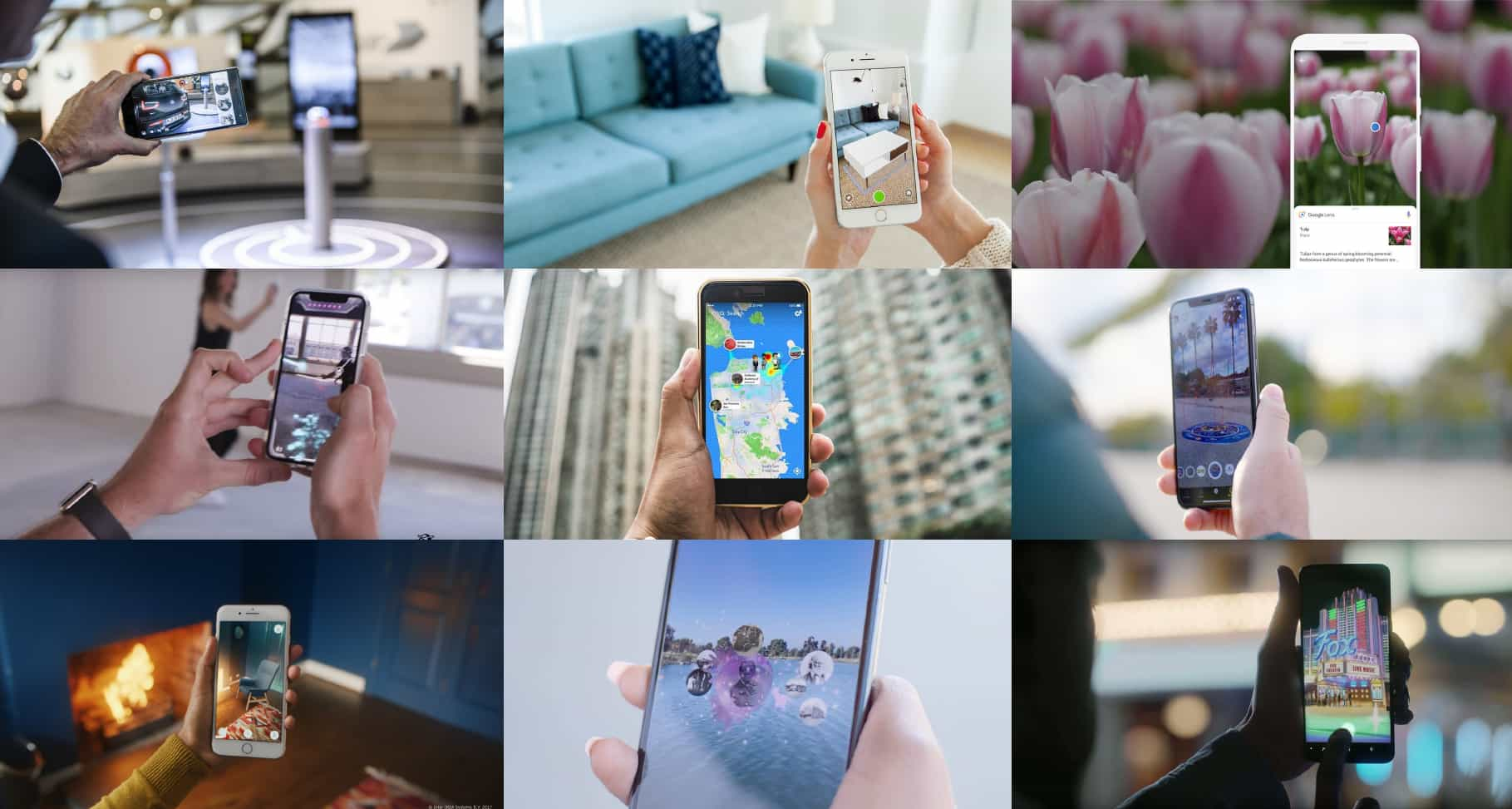

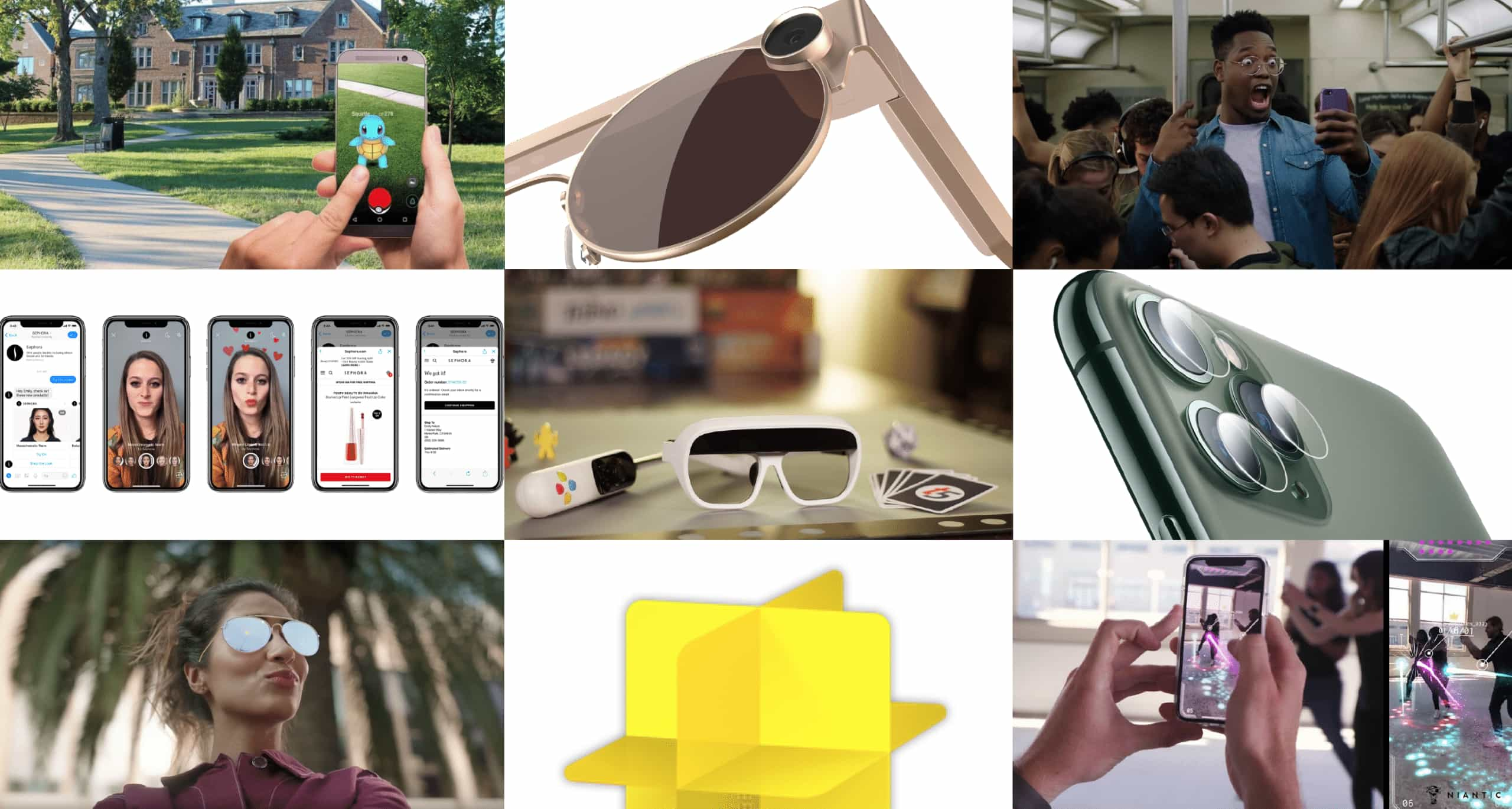

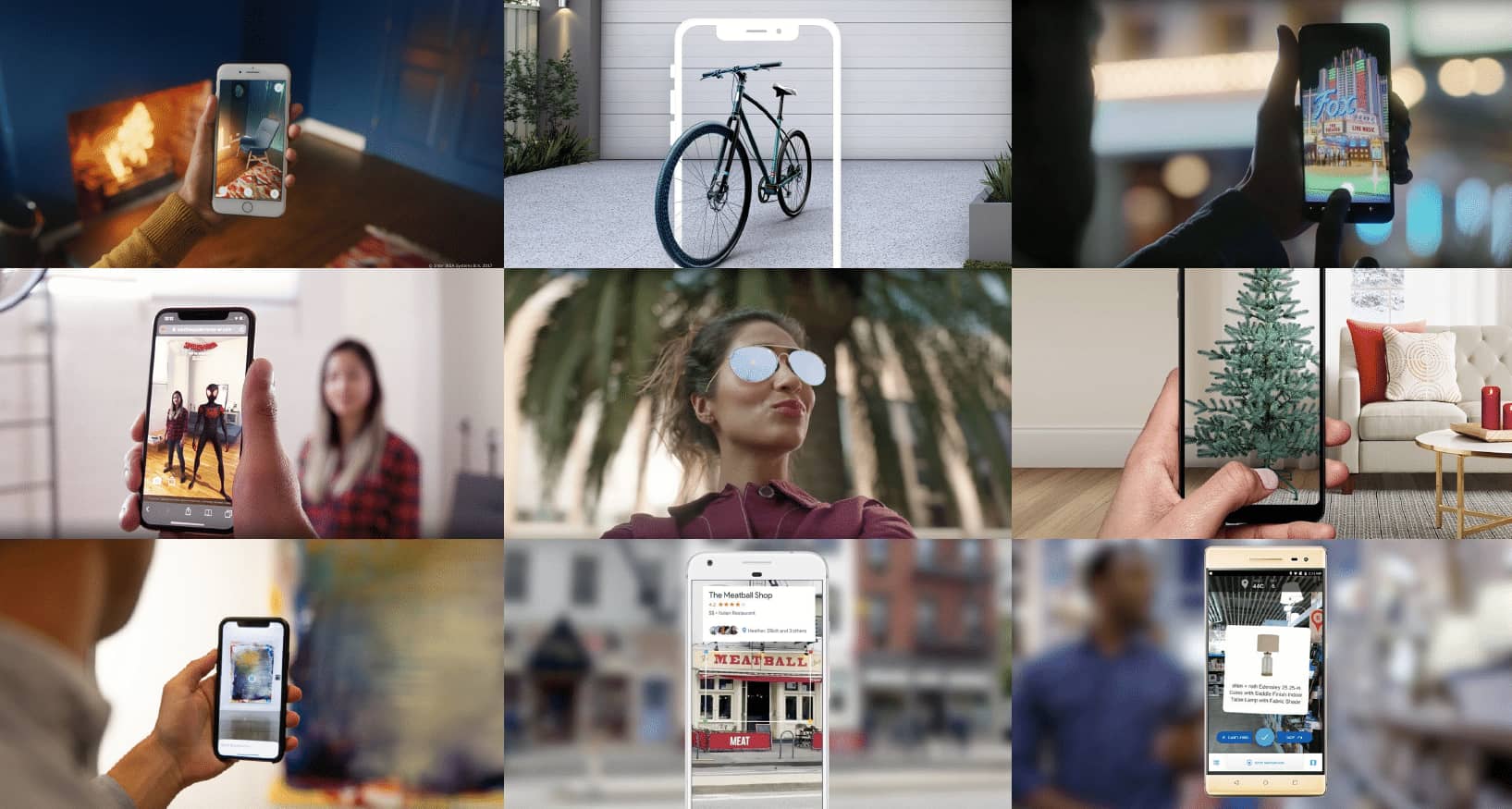

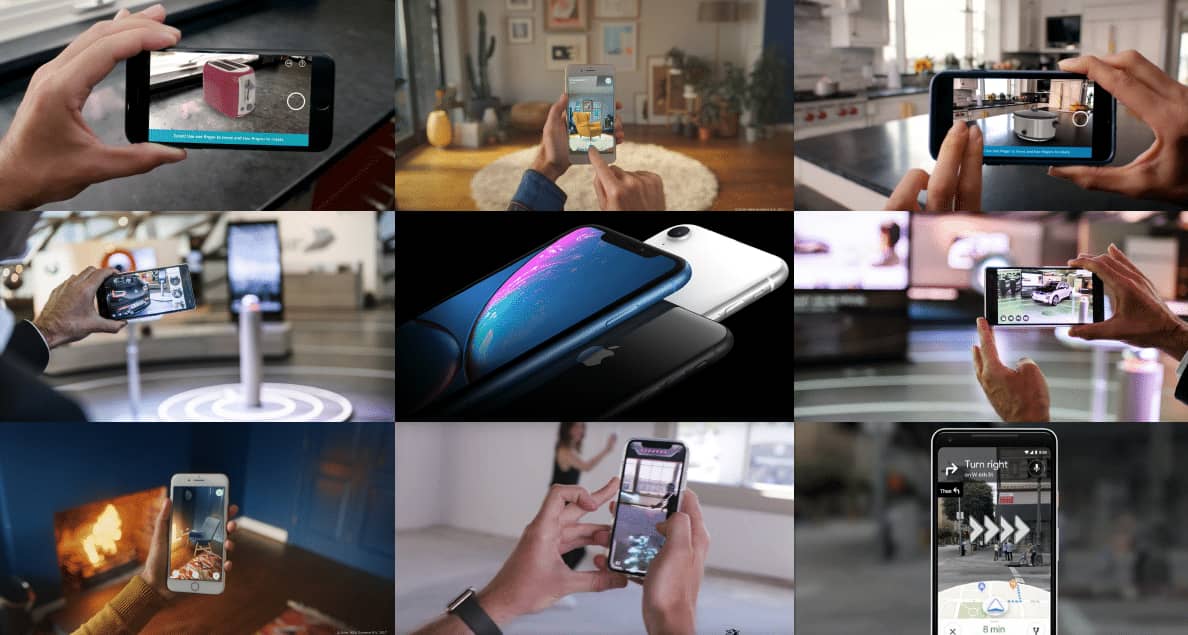

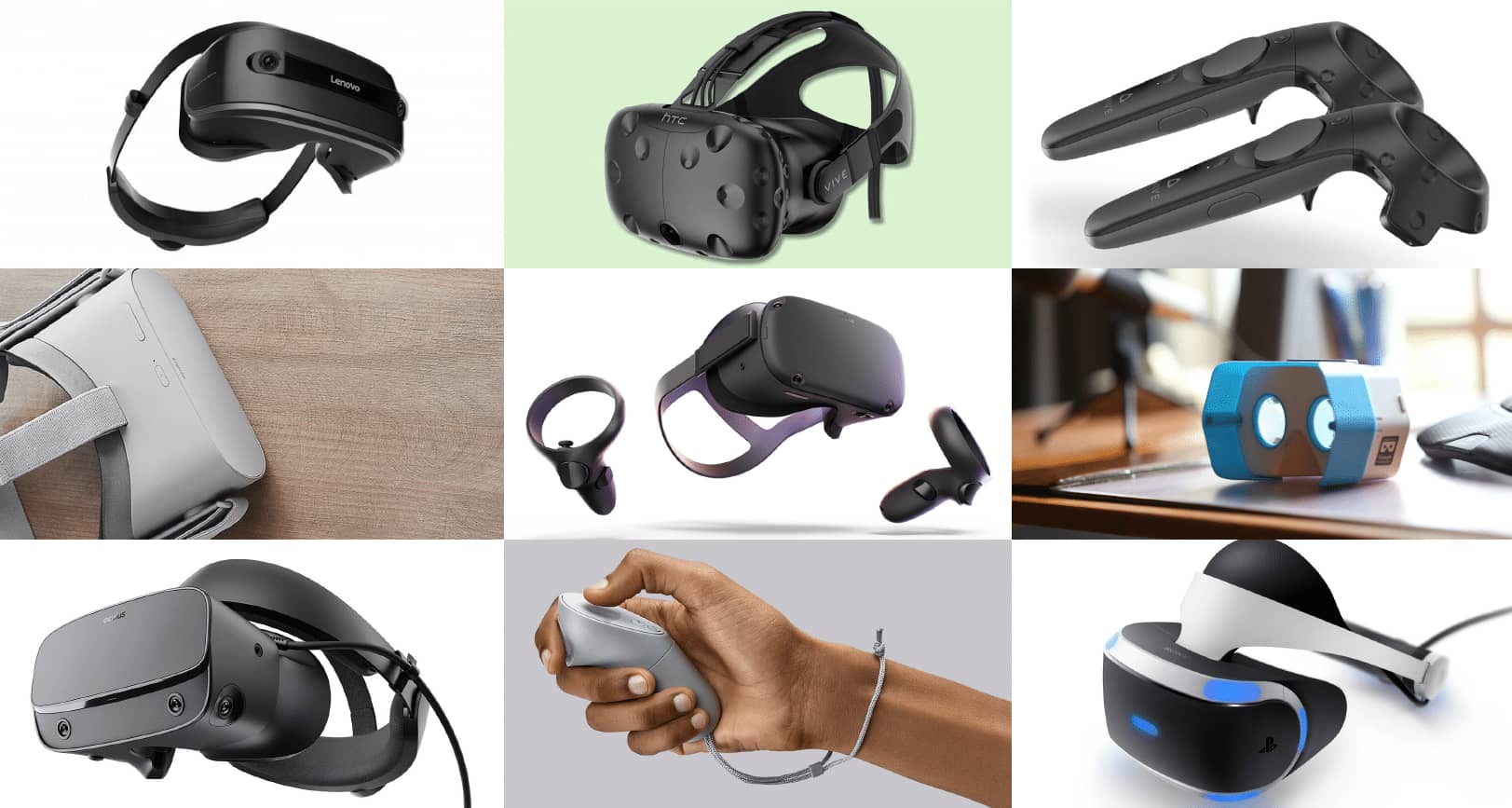

February Report – Reality Check: The State of Spatial Computing, Part 2

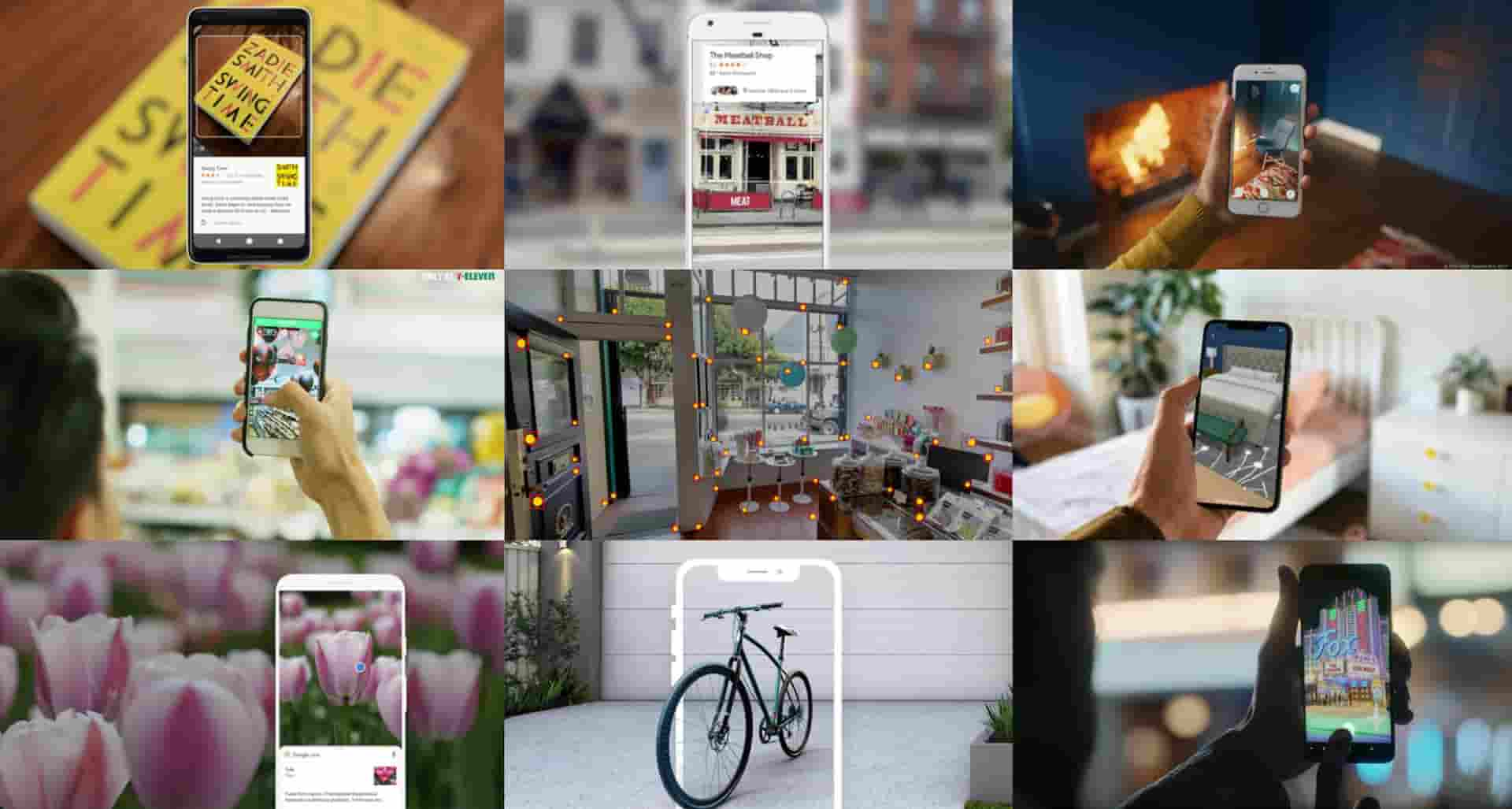

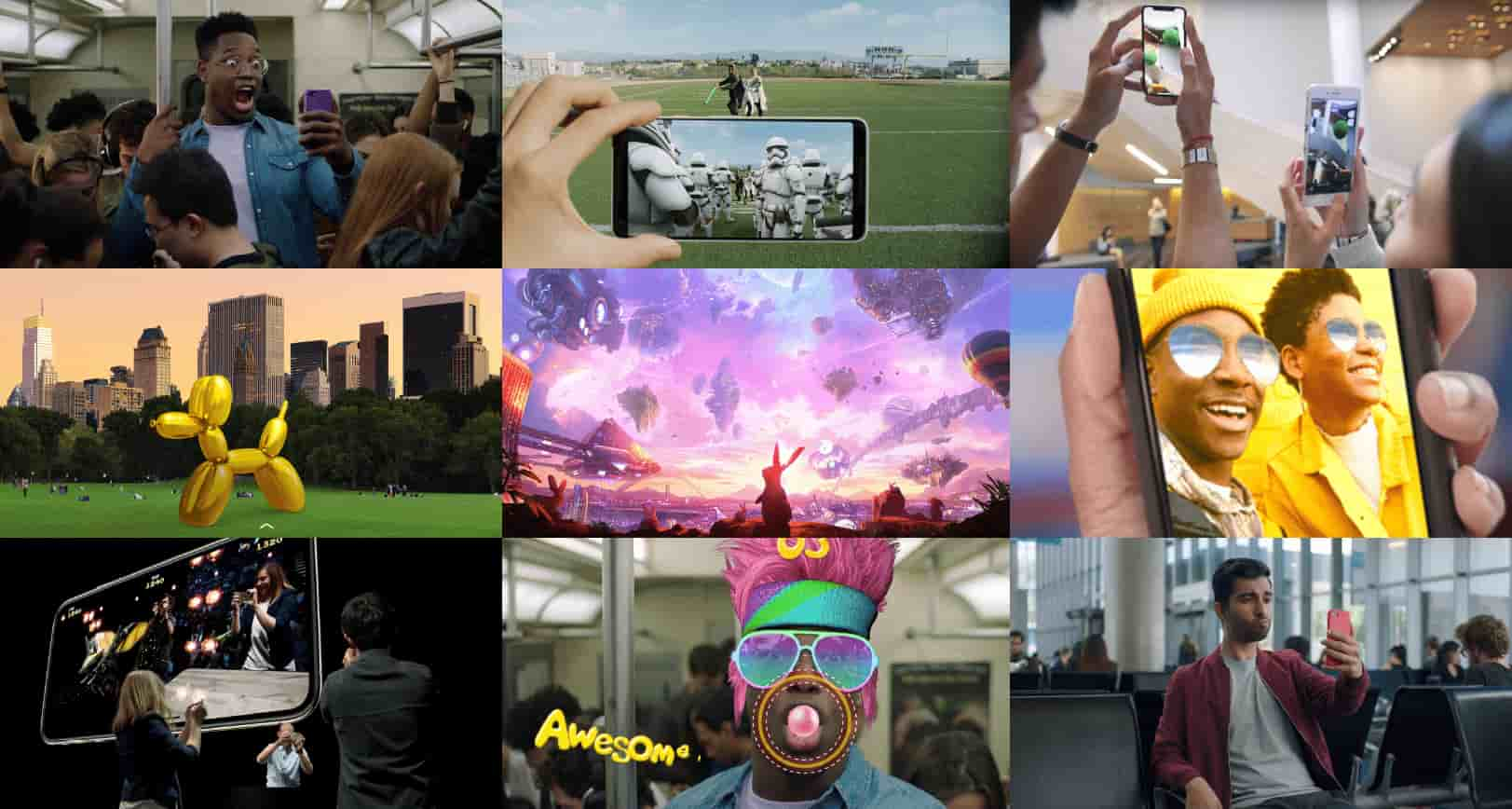

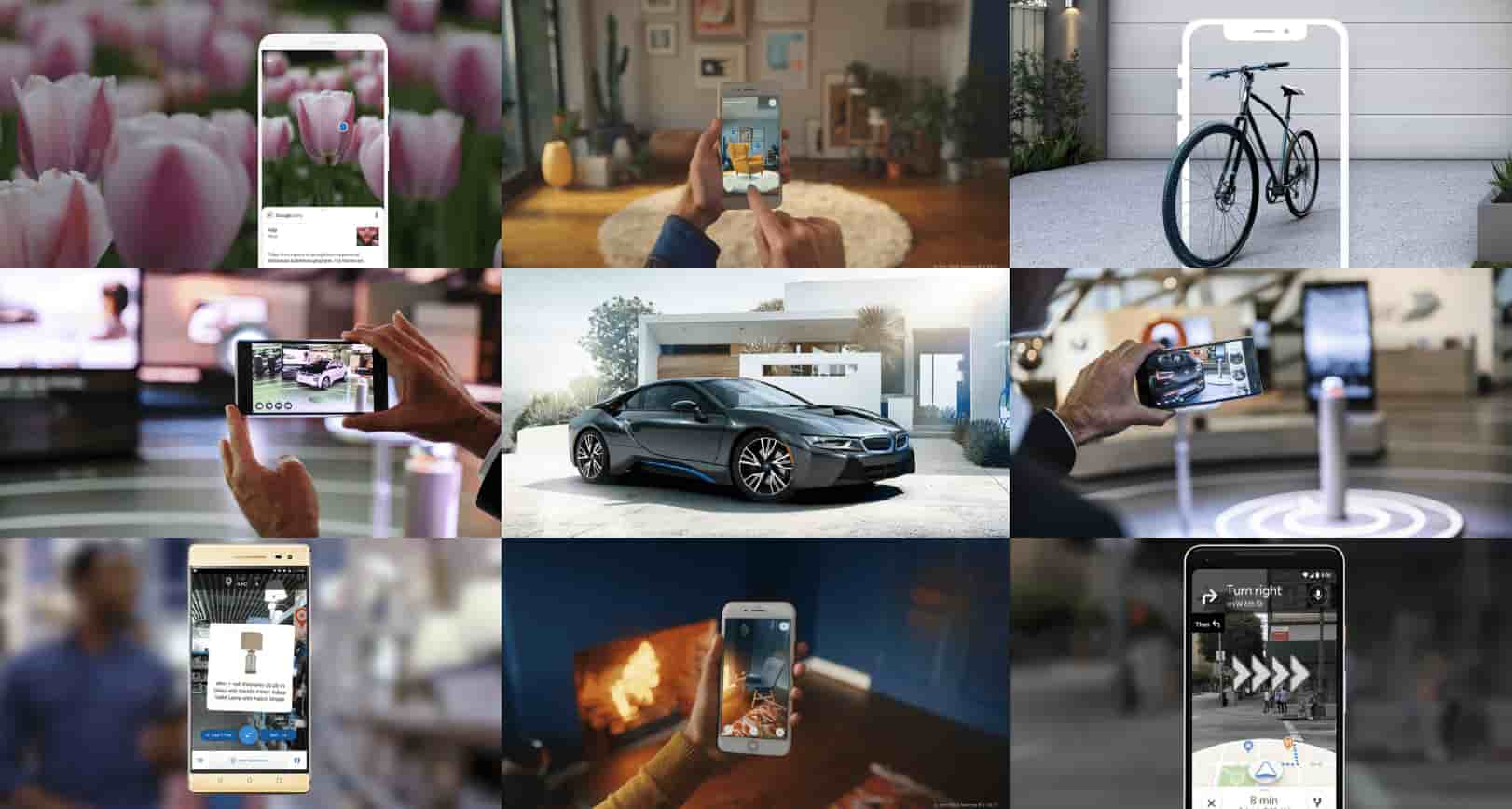

March Report – Mobile AR Global Revenue Forecast: 2025-2030

April Report – Follow the Money: XR Funding Roundup

Gain access to the entire intelligence vault.

For those working in #XR and others looking to educate yourselves on this industry ditch the Wave reports and Hype Cycles and opt for a specialist industry analyst firm. Michael Boland’s team at ARtillery Intelligence delivers original, relevant and well prepped/delivered insights and data analytics on the market trends that matter across the extended reality ecosystem.

Reynaldo Zabala

XR Strategy Director / RazorEdge