The latest original intelligence. Subscribers, log in for full access.

Monthly reports since 2017. Subscribers, log in for full access.

Latest

Latest

Archive

Archive

Latest

Latest

Archive

Archive

What’s coming up…

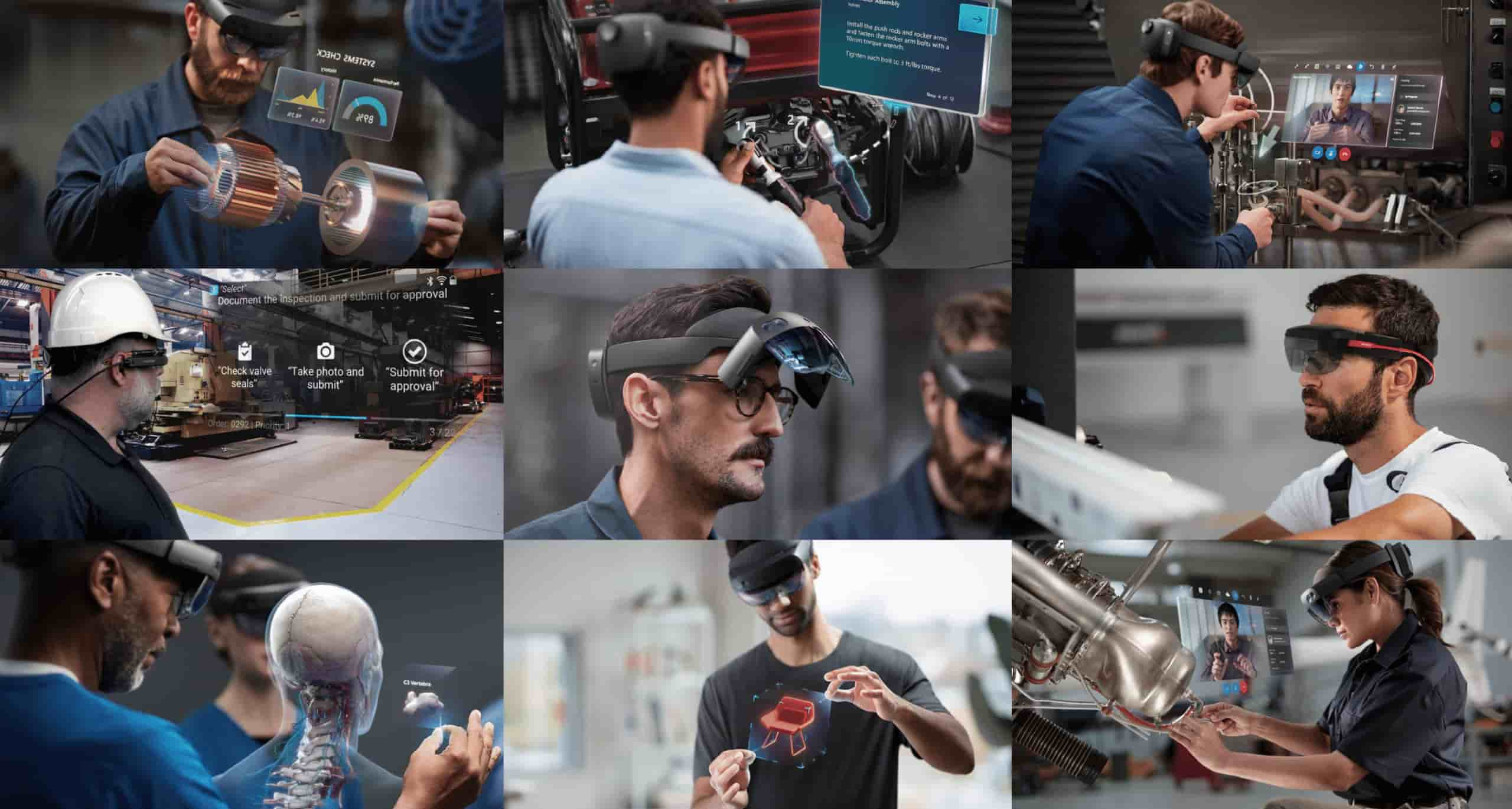

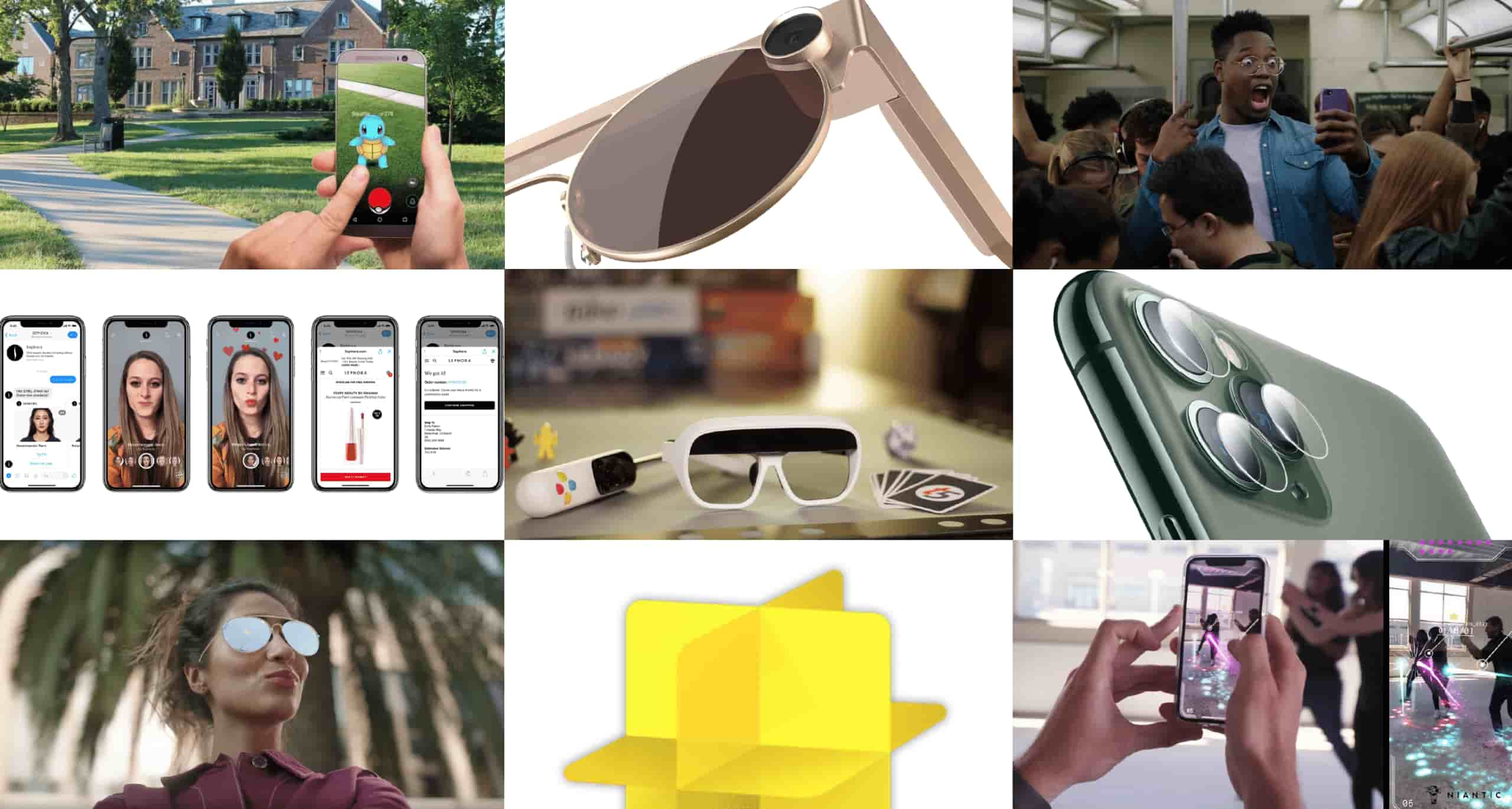

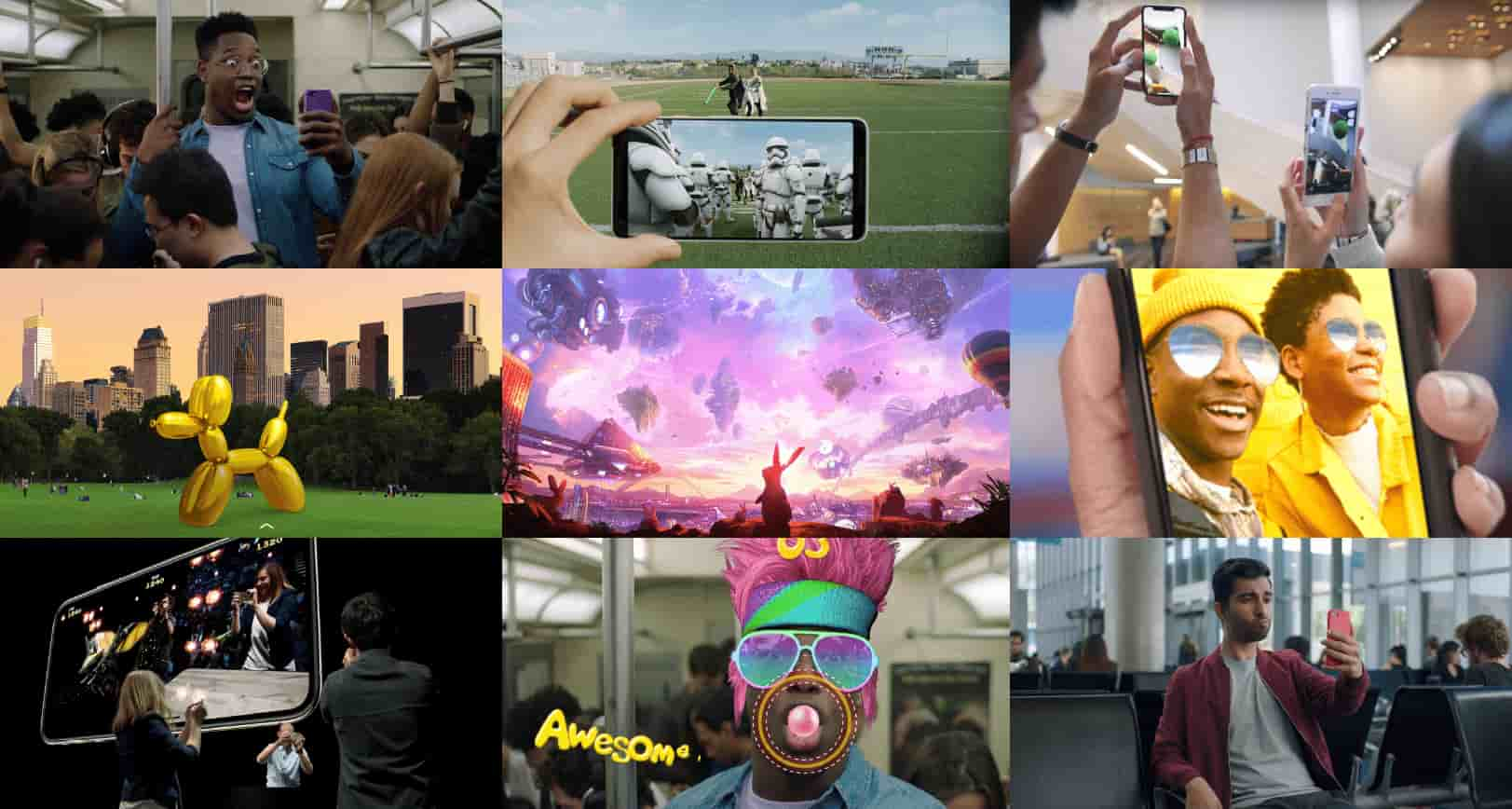

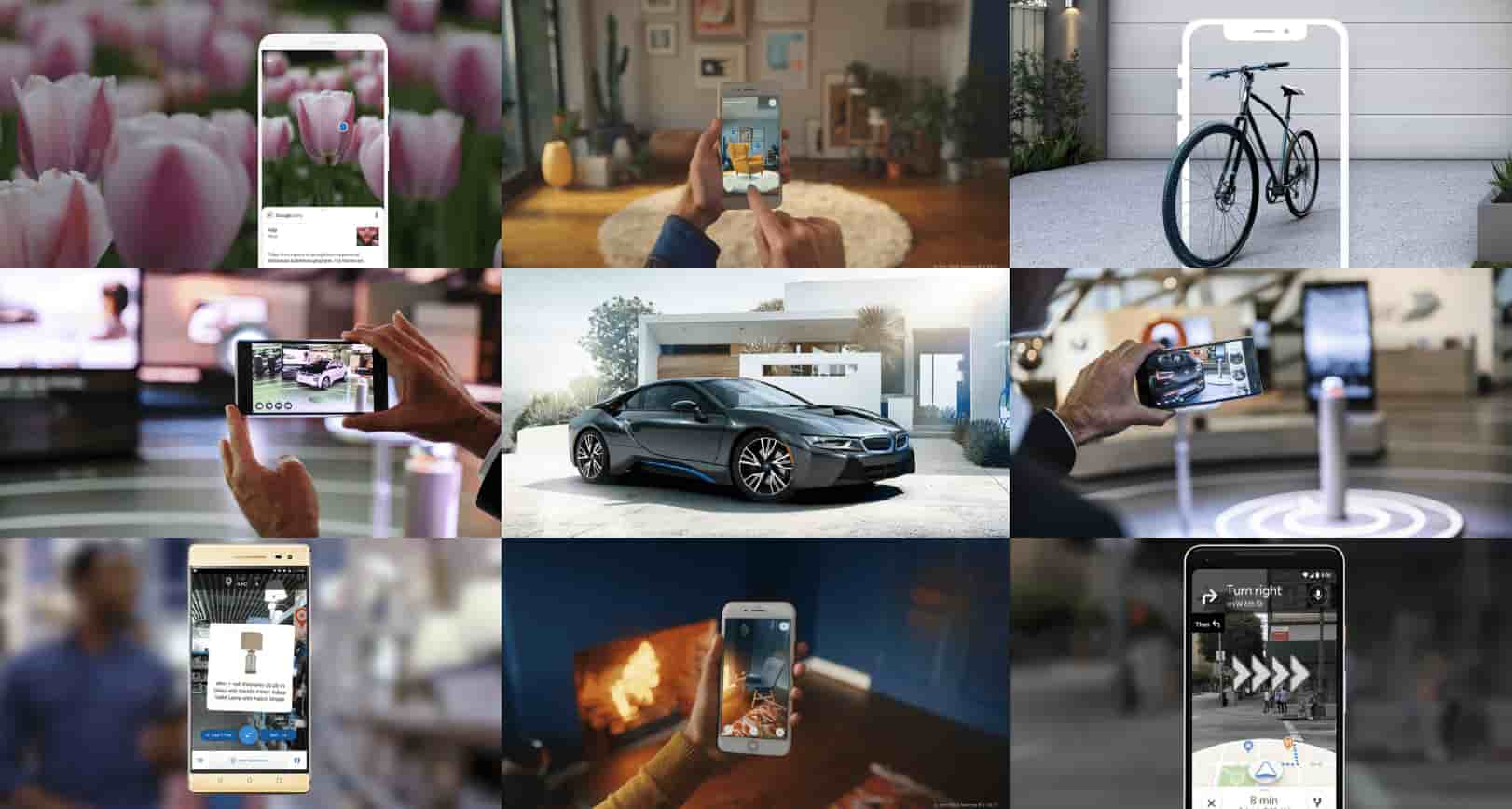

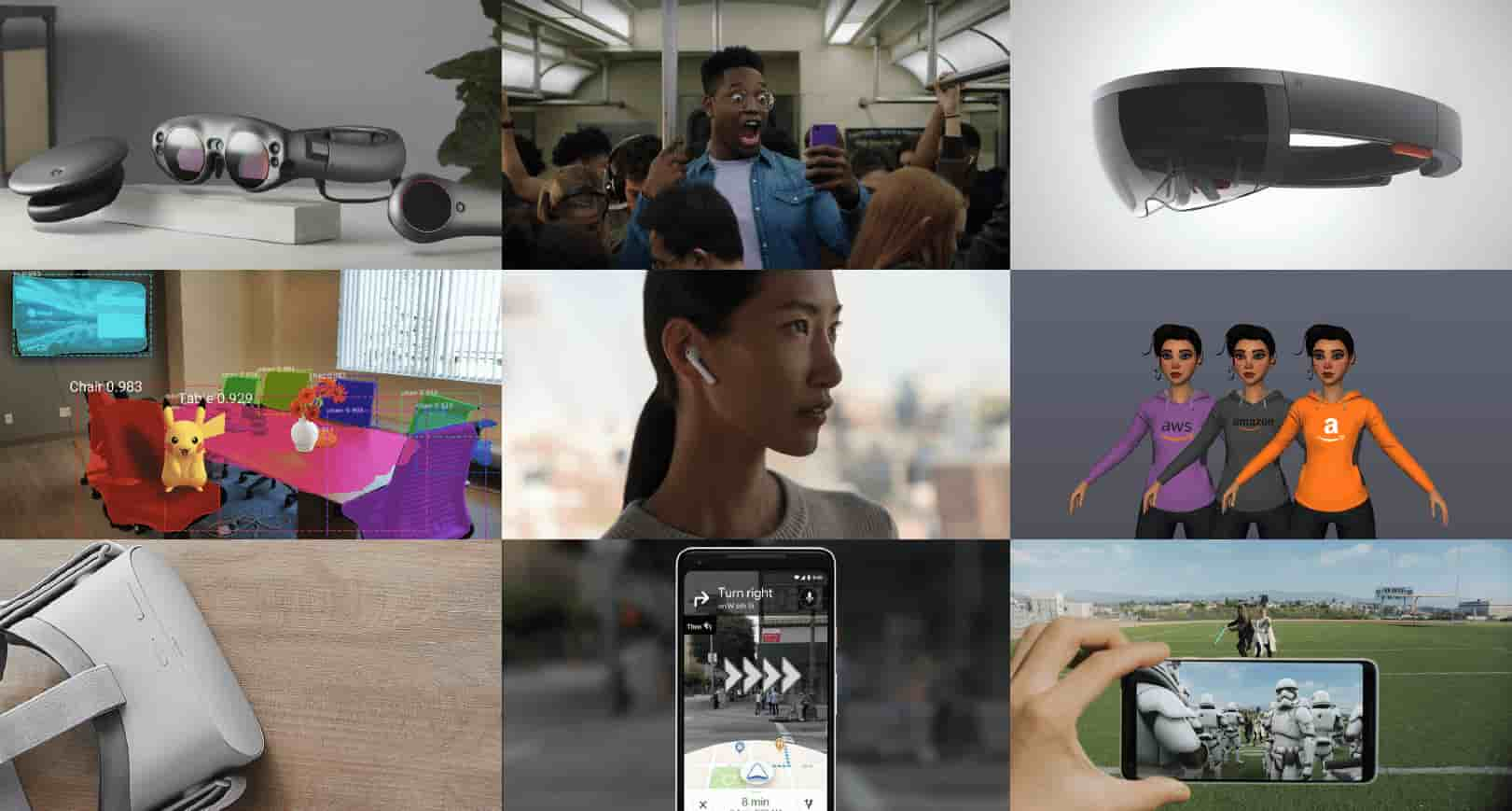

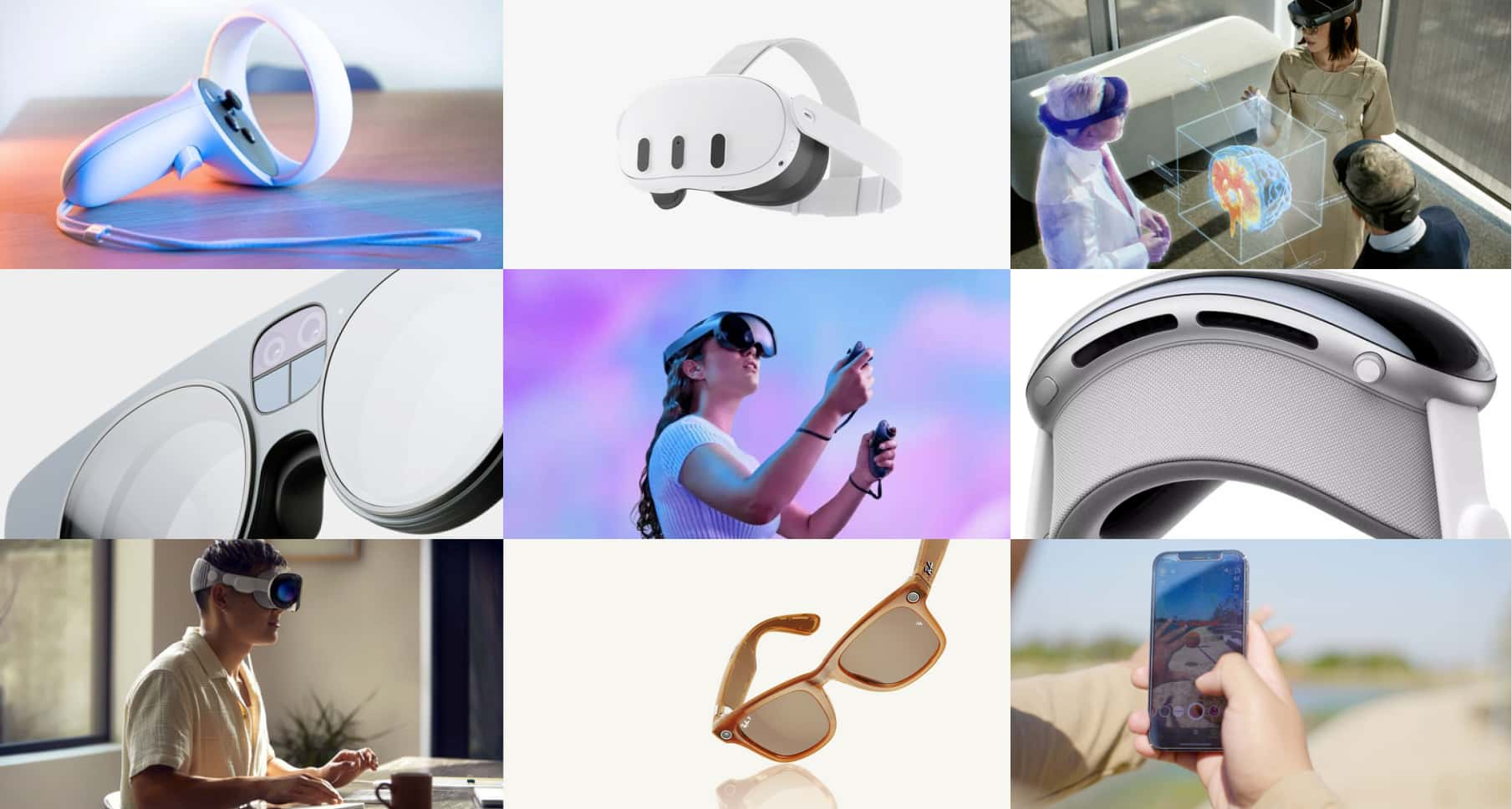

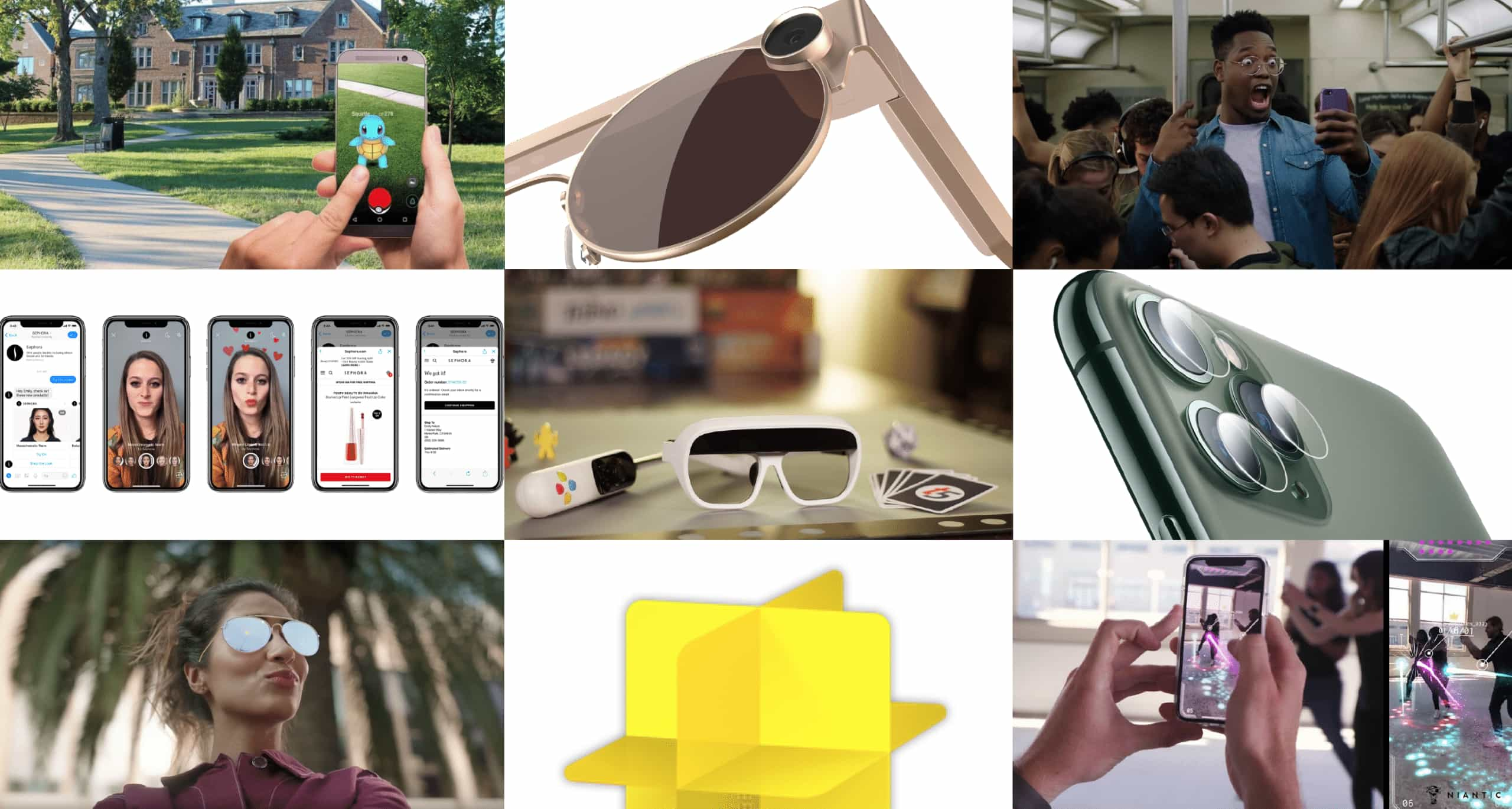

July Report – AR Usage & Consumer Attitudes, Wave 9

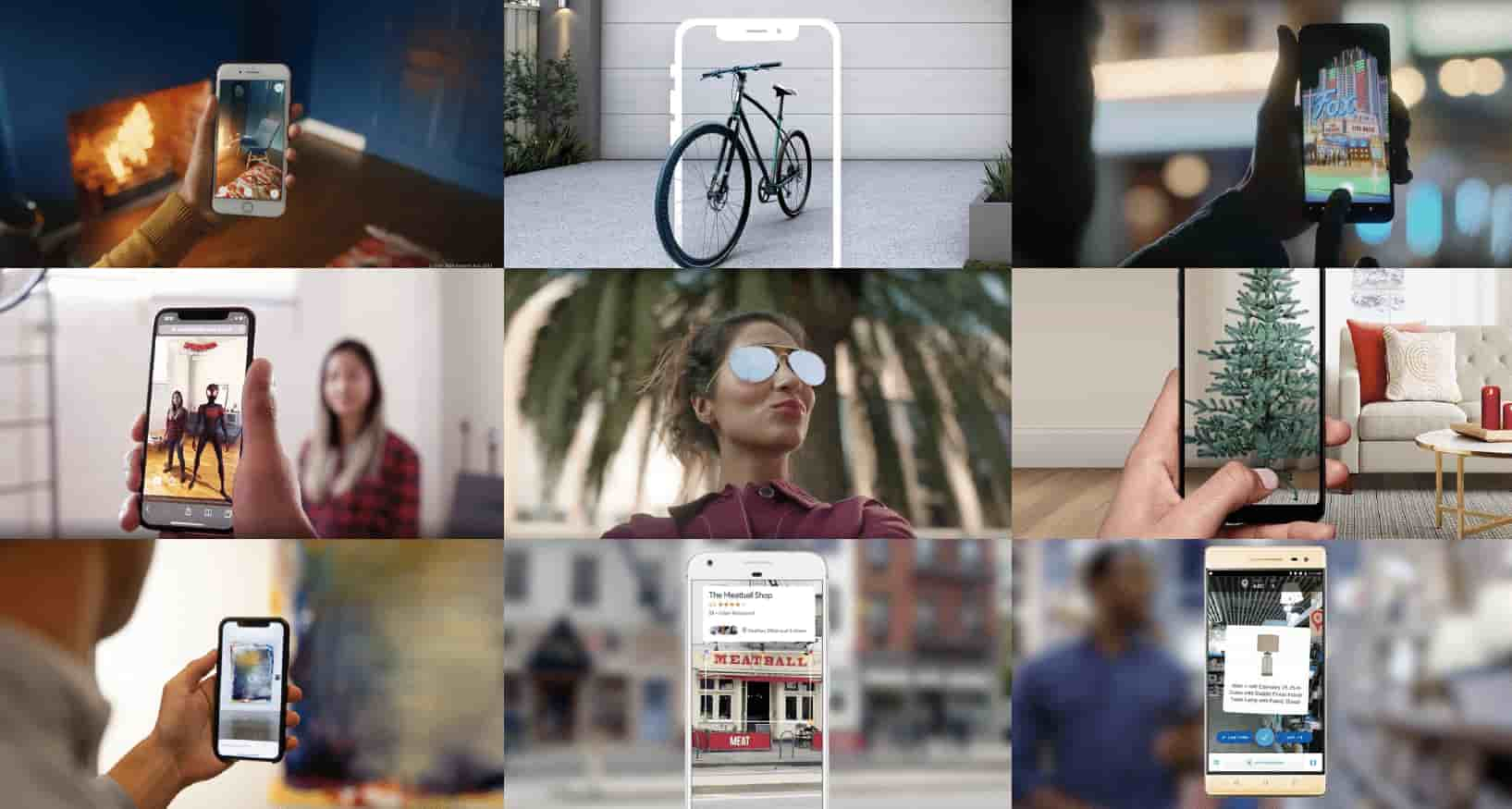

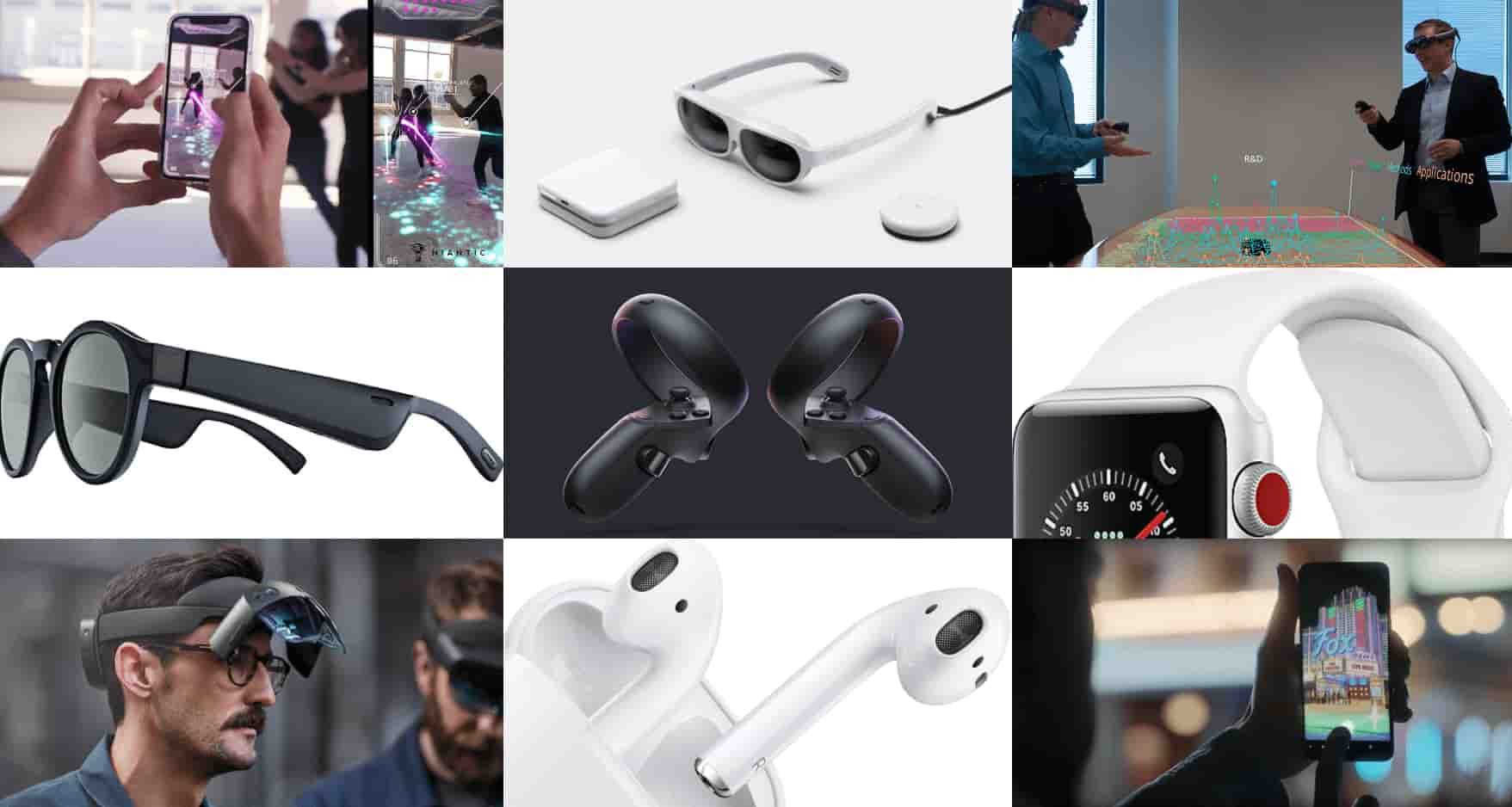

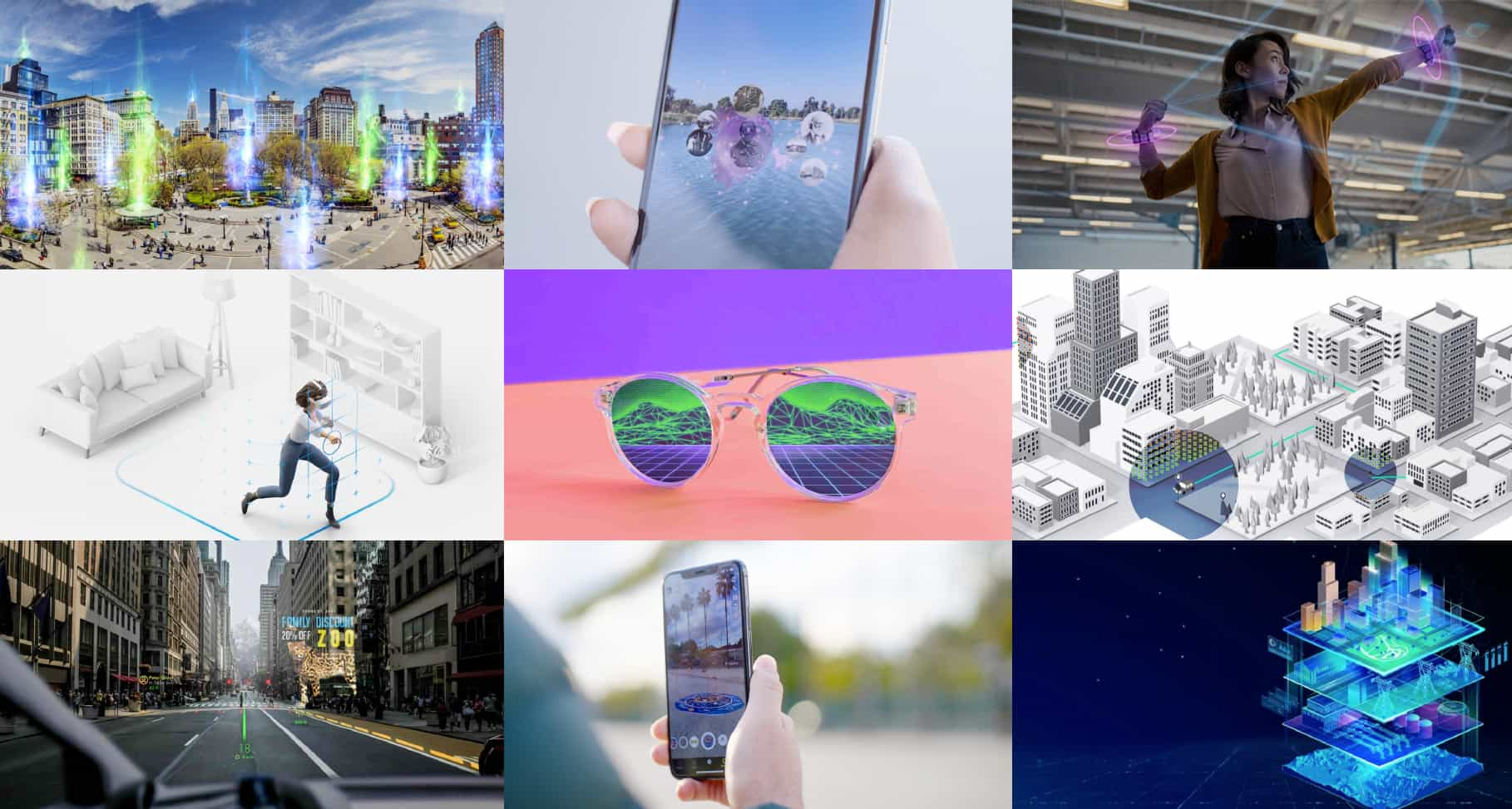

August Report – AR Marketing Best Practices & Case Studies, Vol. 5

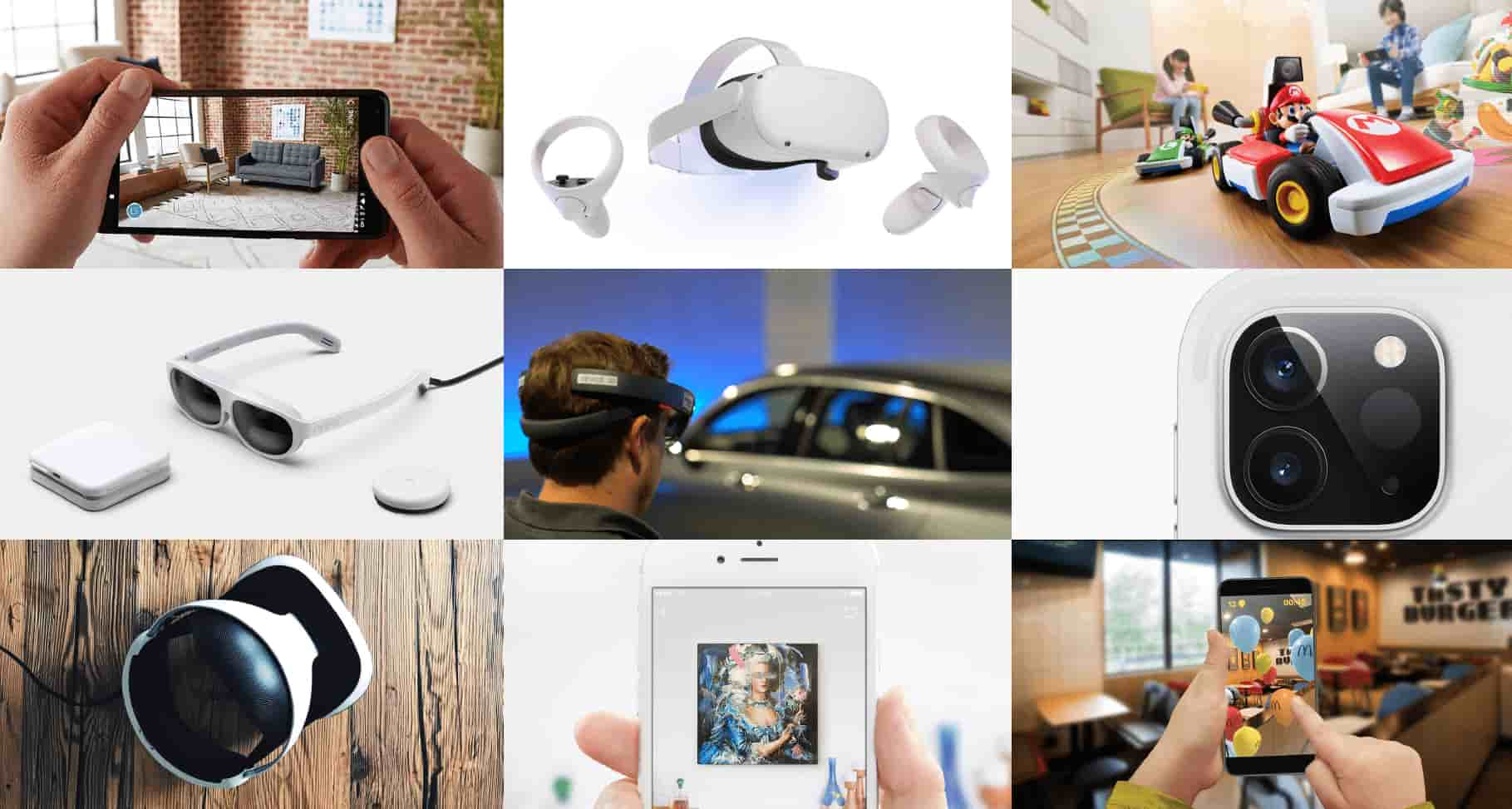

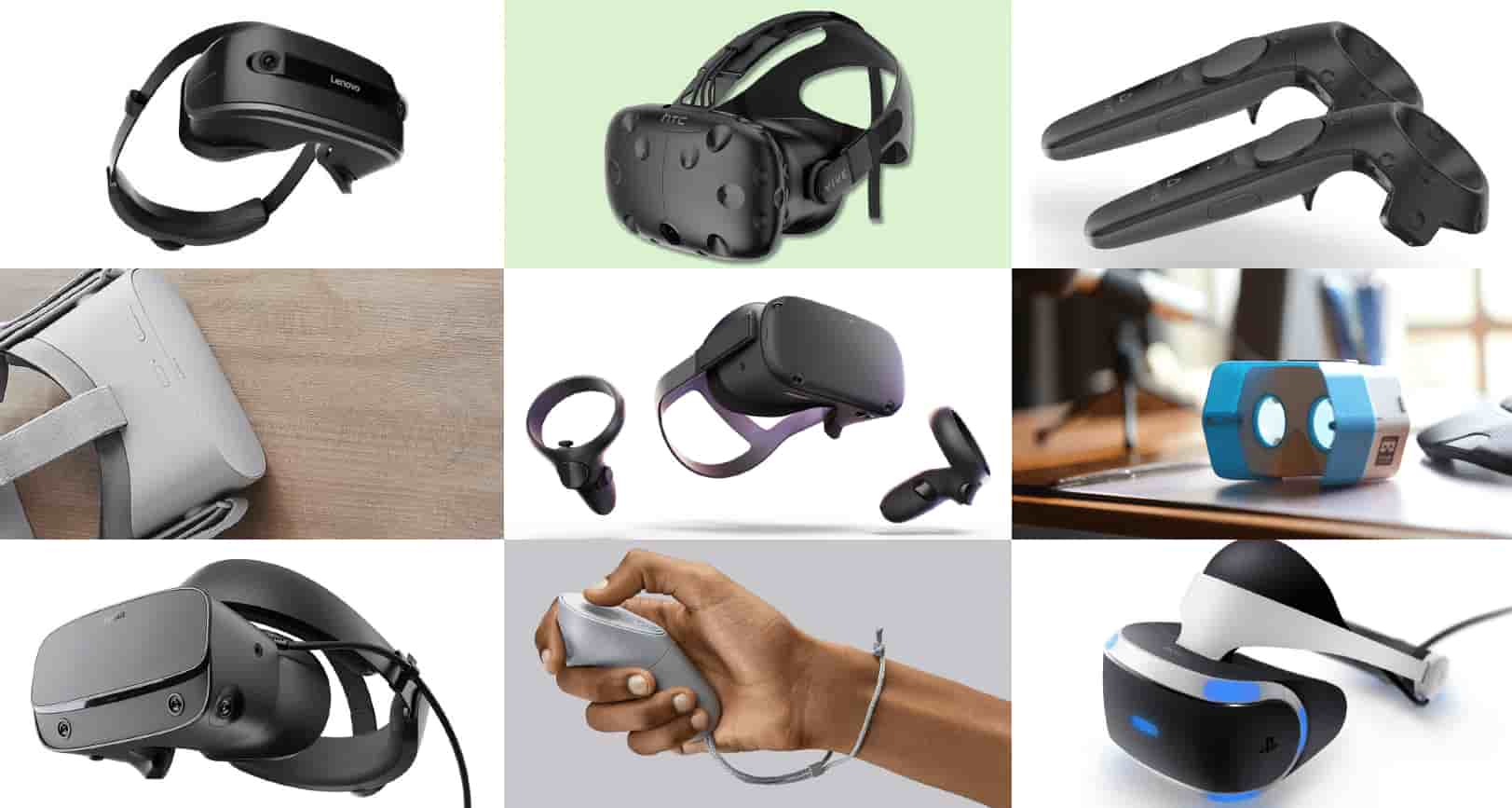

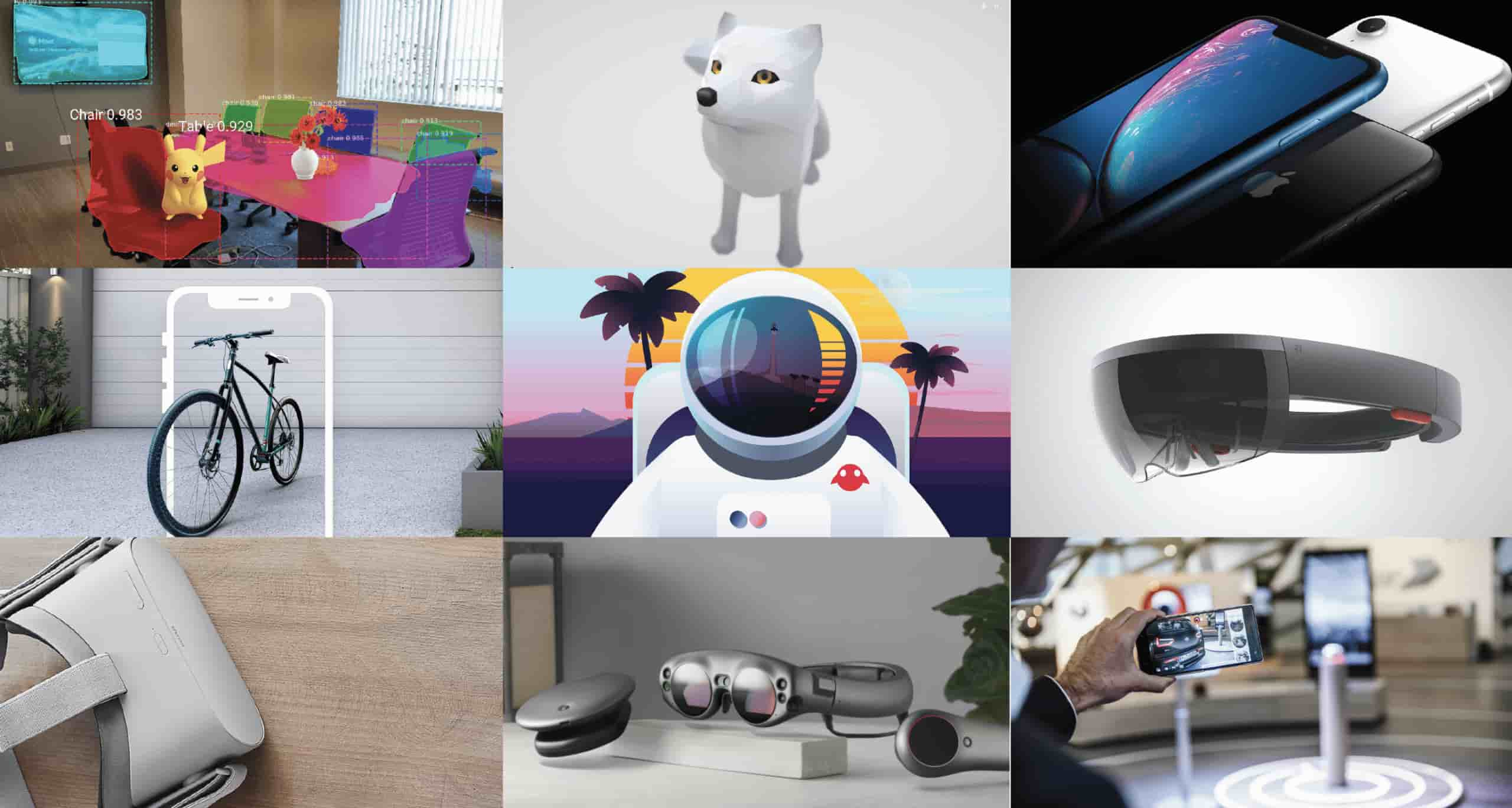

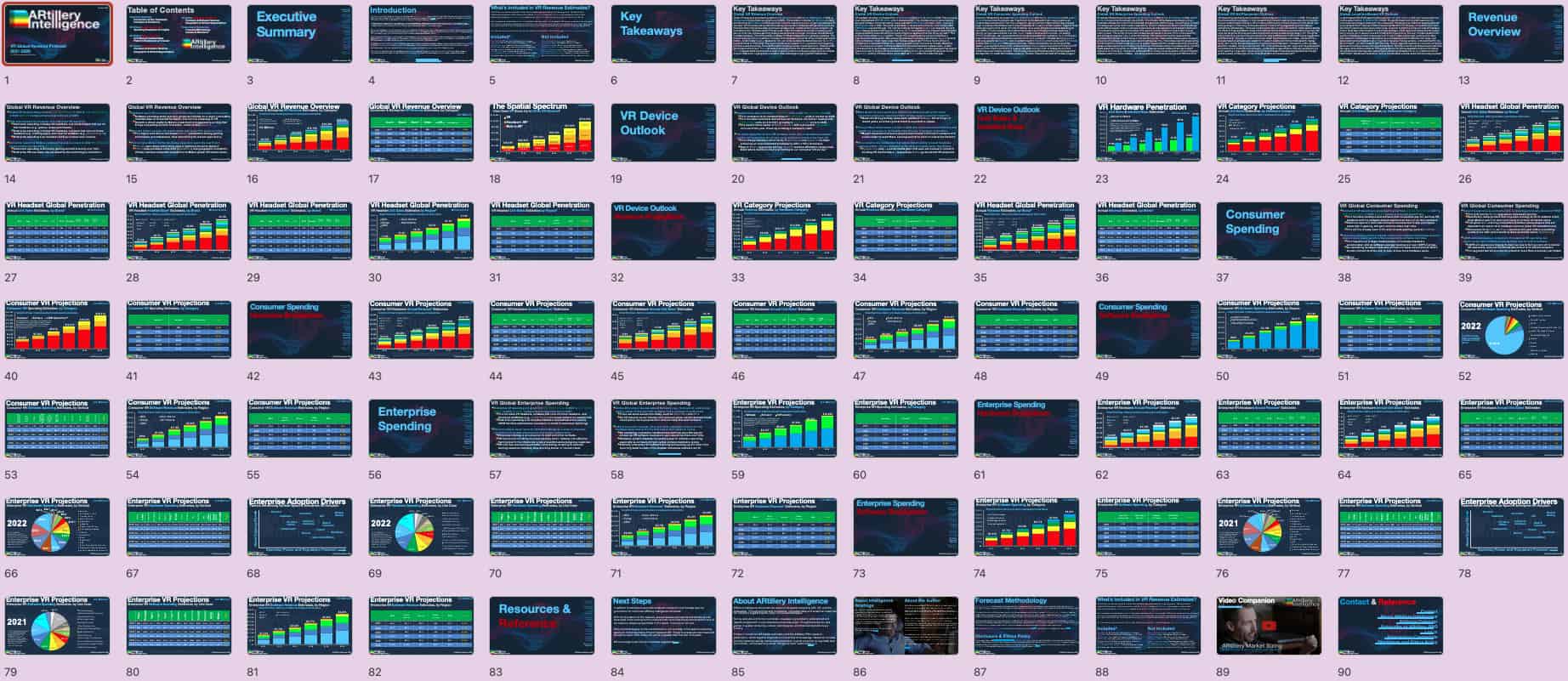

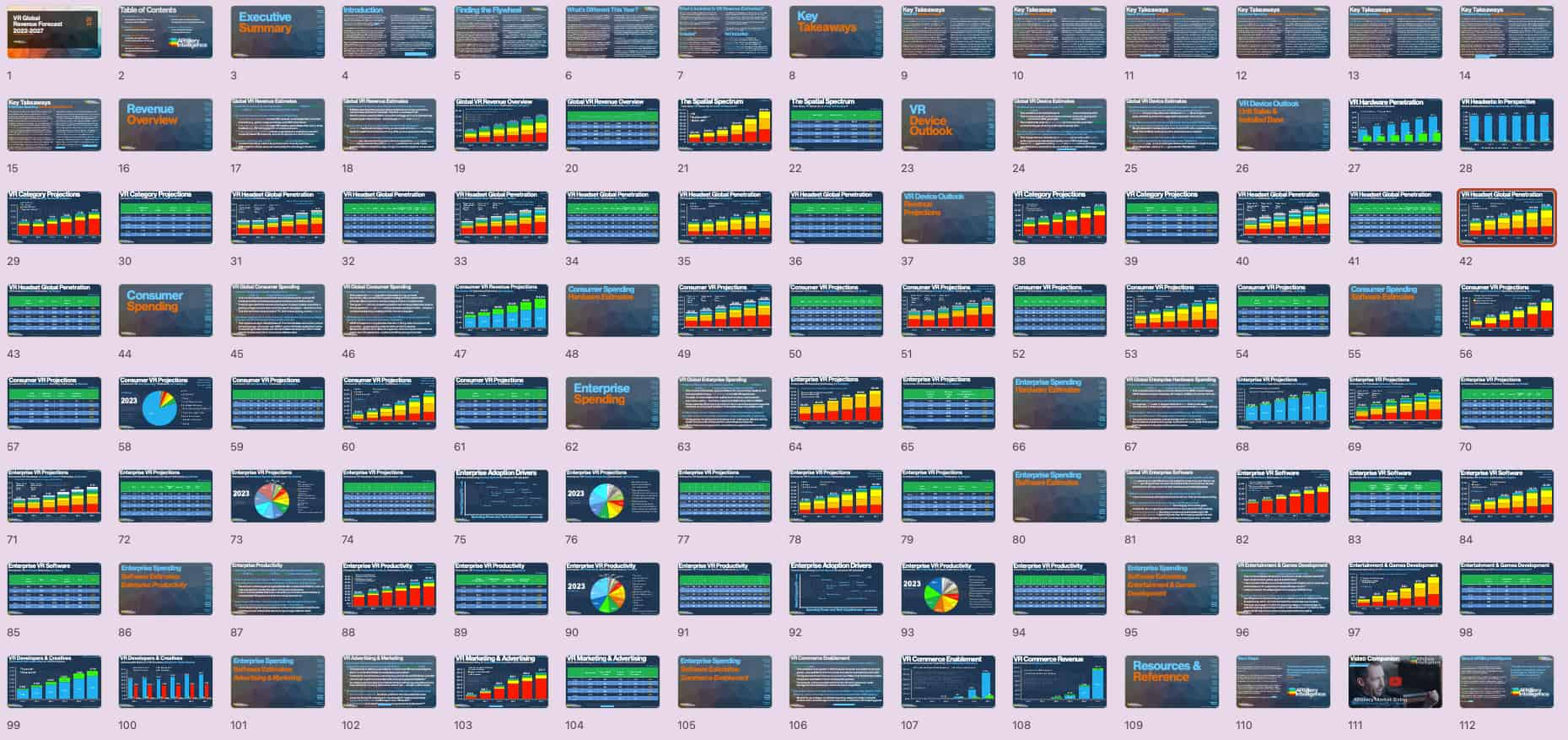

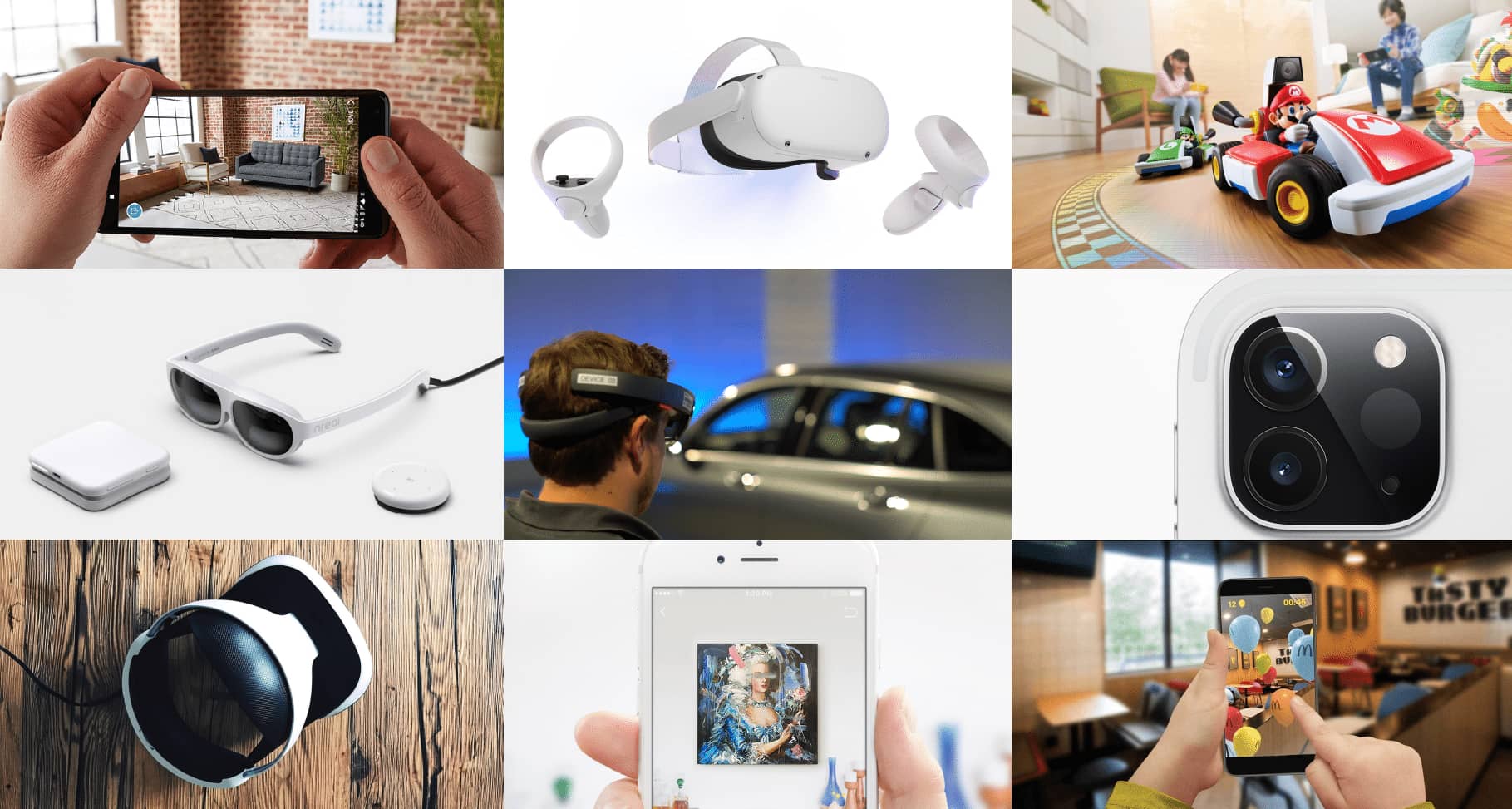

September Report – VR Global Revenue Forecast: 2024-2029

Gain access to the entire intelligence vault.

For those working in #XR and others looking to educate yourselves on this industry ditch the Wave reports and Hype Cycles and opt for a specialist industry analyst firm. Michael Boland’s team at ARtillery Intelligence delivers original, relevant and well prepped/delivered insights and data analytics on the market trends that matter across the extended reality ecosystem.

Reynaldo Zabala

XR Strategy Director / RazorEdge