Browse ARtillery’s reports library. Subscribers, log in for full reports.

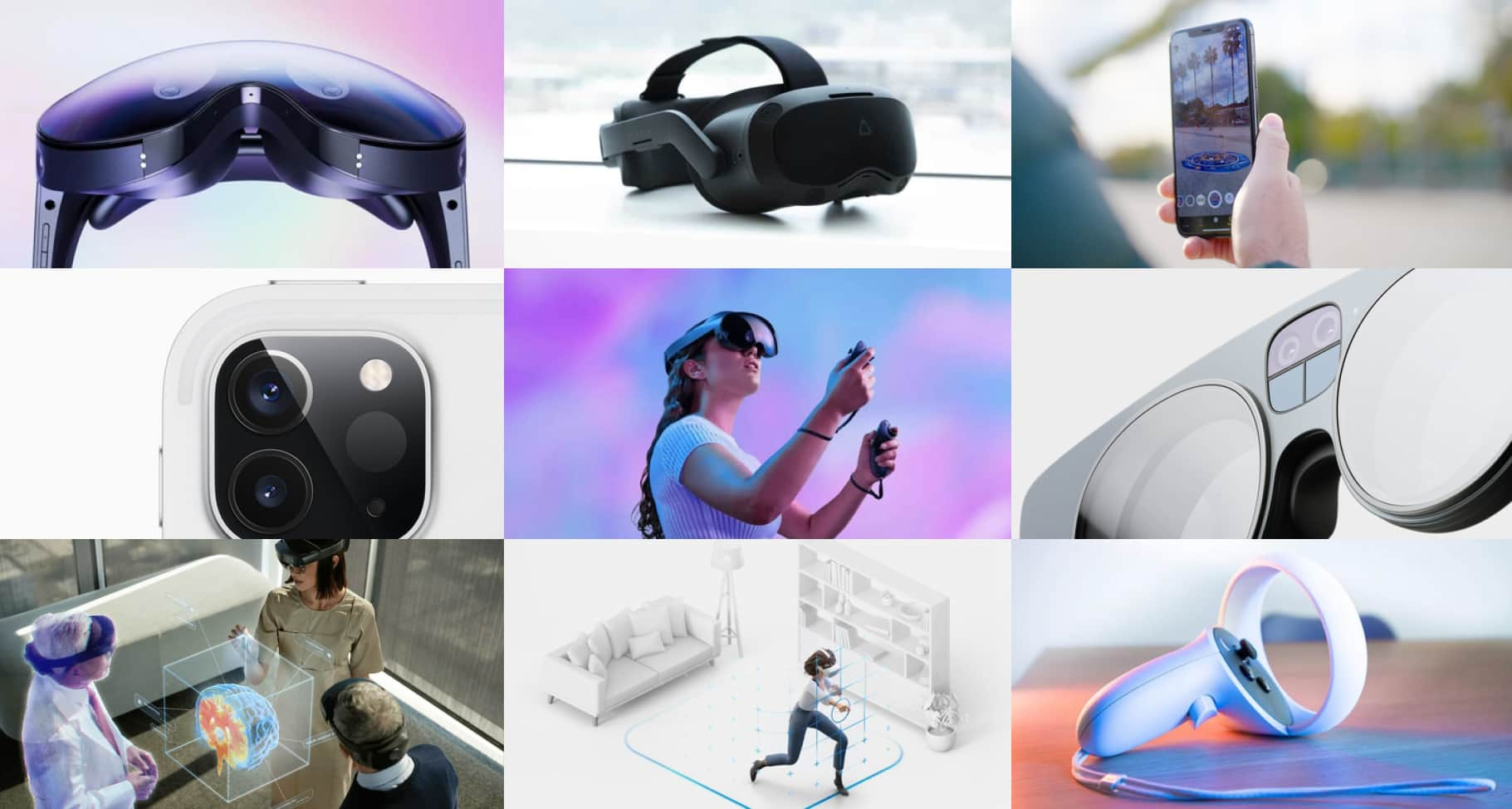

Refreshed monthly. Subscribers, log in for the full report.

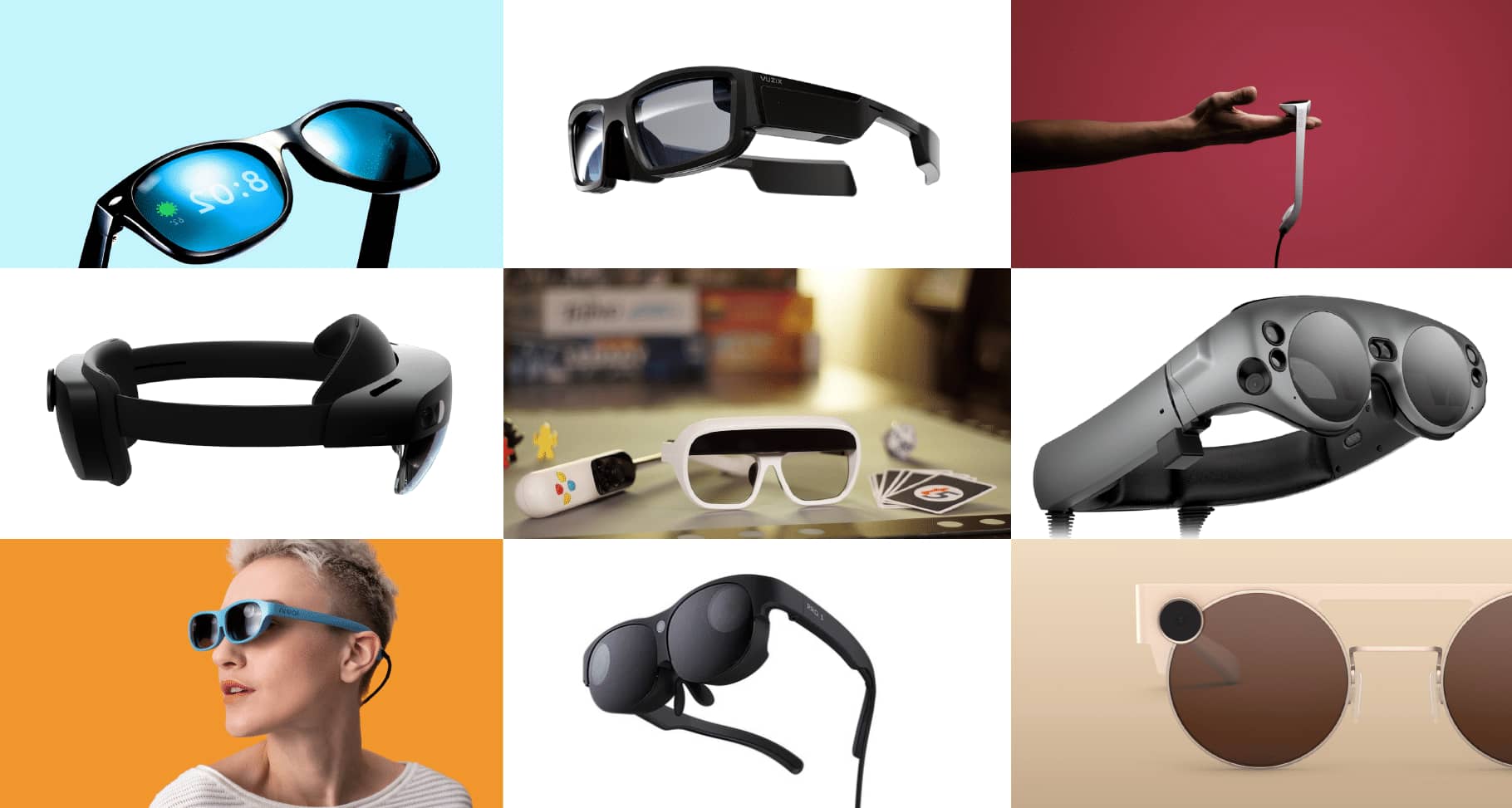

Monthly reports since 2017. Subscribers, log in for full access.

Latest

Latest

Archive

Archive

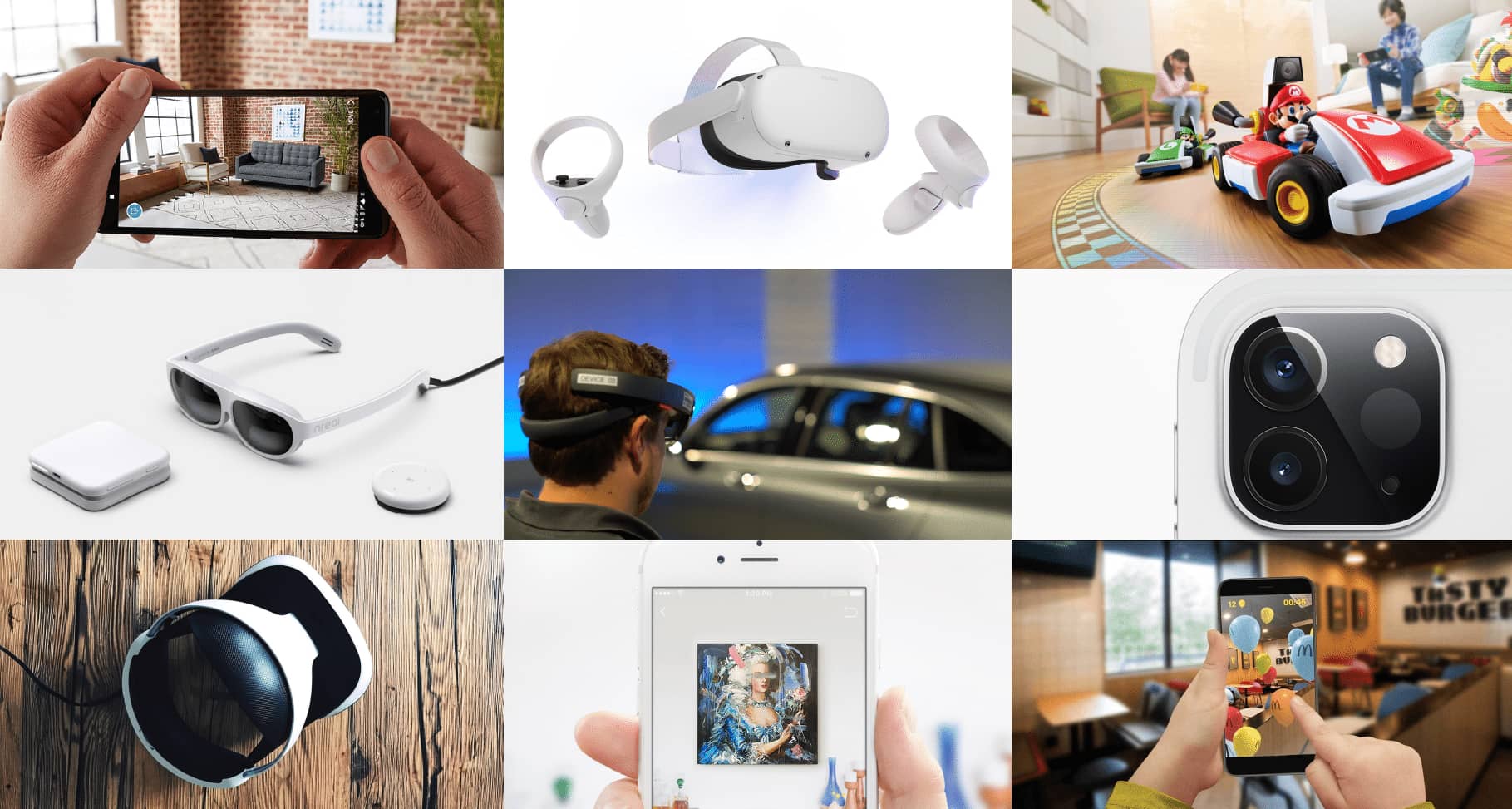

Latest

Latest

Archive

Archive

What’s coming up…

May Report – AR Usage & Consumer Attitudes, Wave VII

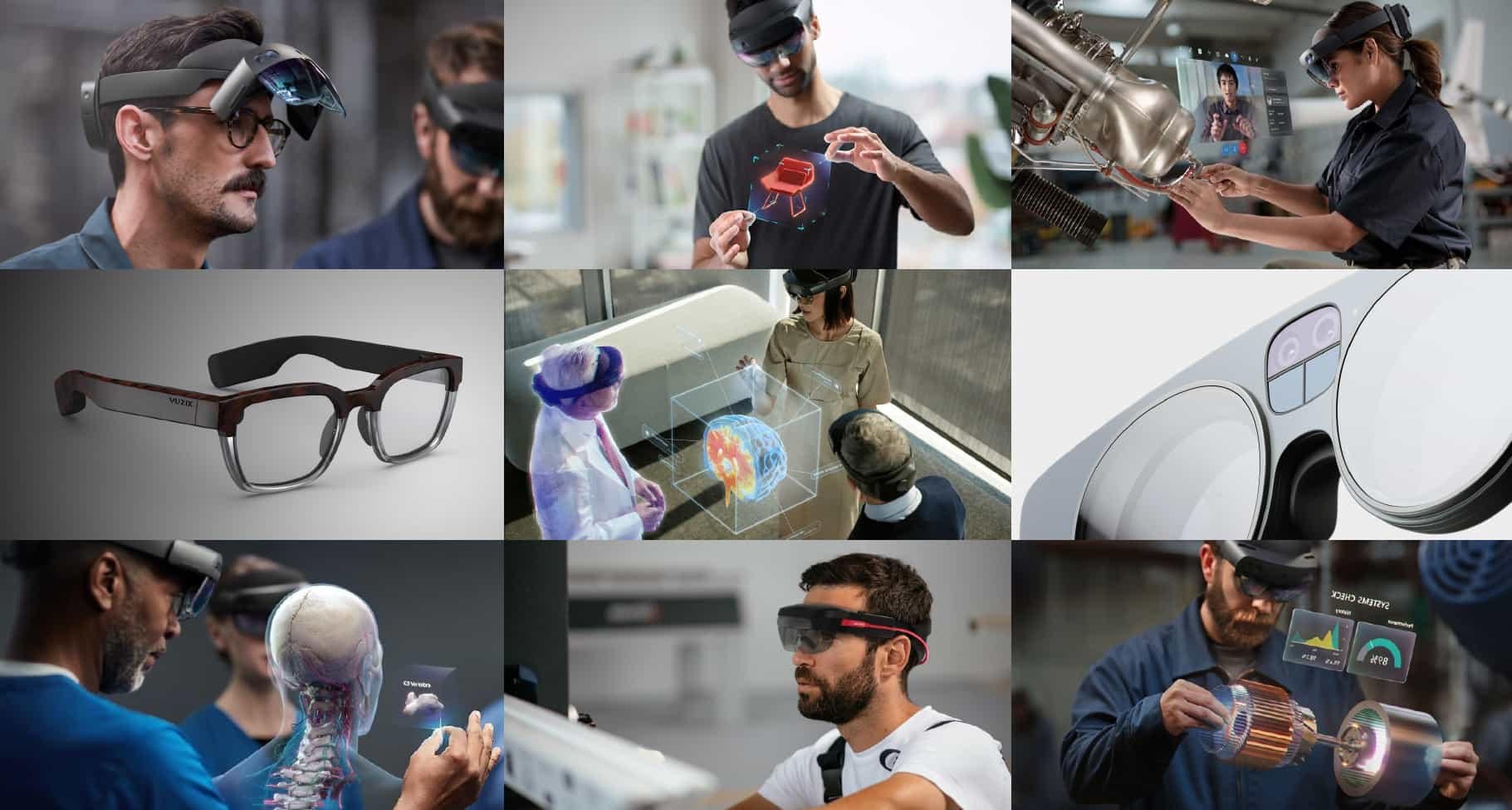

June Report – Headworn Global Revenue Outlook: 2023-2028

July Report – Enterprise XR Best Practices & Case Studies, Volume 3

Gain access to the entire intelligence vault.

For those working in #XR and others looking to educate yourselves on this industry ditch the Wave reports and Hype Cycles and opt for a specialist industry analyst firm. Michael Boland’s team at ARtillery Intelligence delivers original, relevant and well prepped/delivered insights and data analytics on the market trends that matter across the extended reality ecosystem.

Reynaldo Zabala

XR Strategy Director / RazorEdge